A Look Back at Q4 '22 Public Cloud Software Earnings

About

- Author: Clouded Judgement

A Look Back at Q4 ‘22 Public Cloud Software Earnings

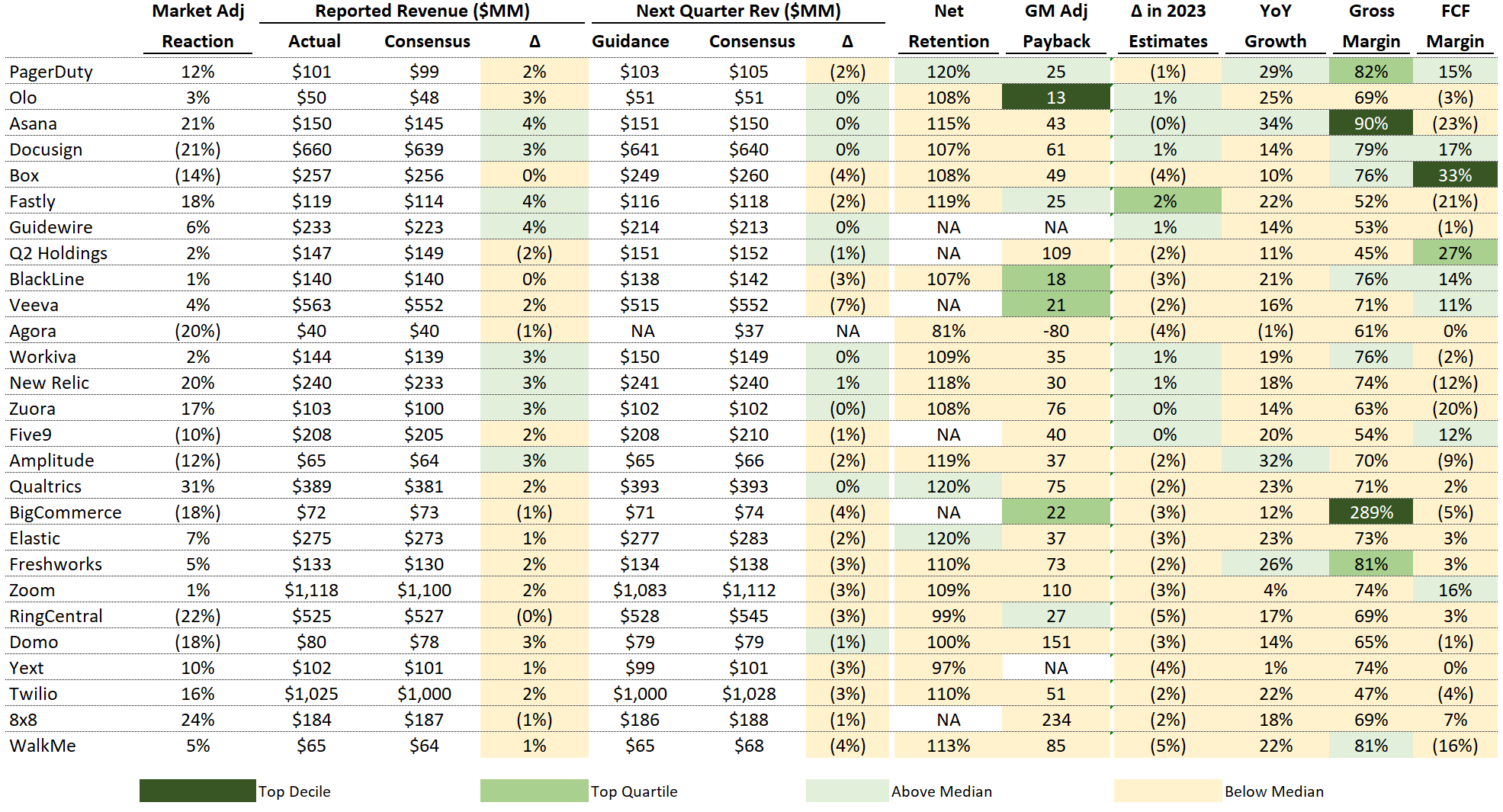

When Will Macro Improve? ATTACH

Morgan Stanley CIO survey I see signs that the market is starting to stabilize (not improve, but not getting worse).

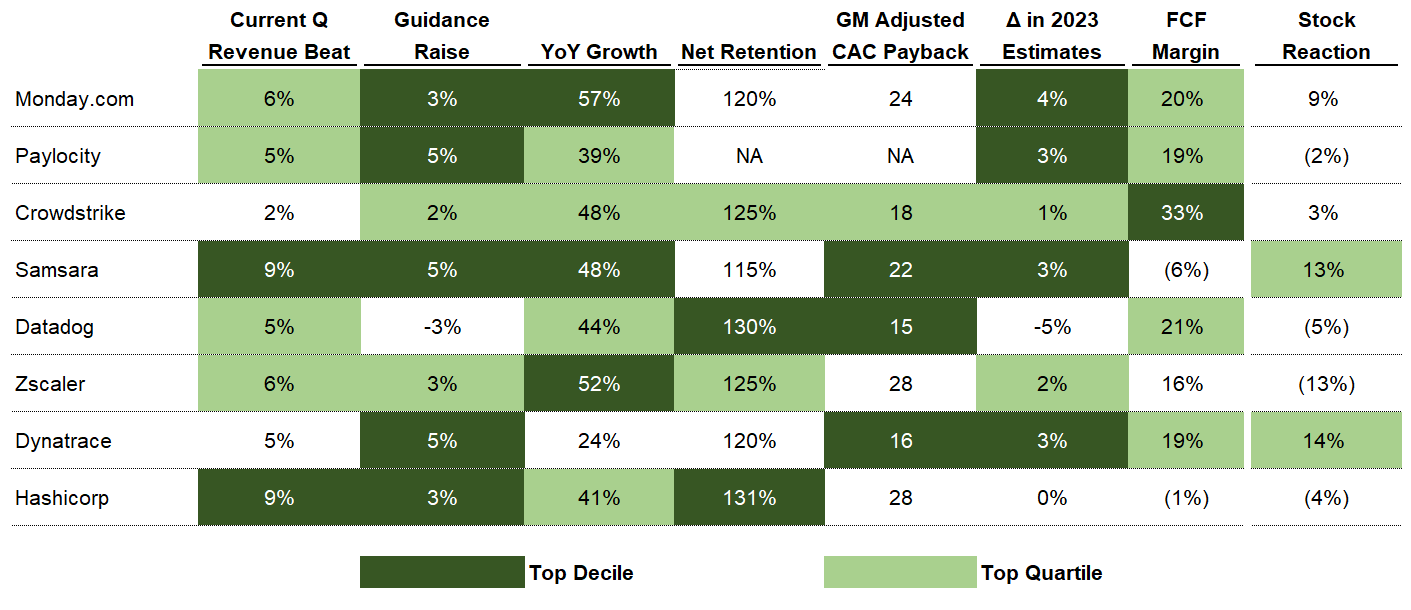

Q4 Top Performers

Growth

FCF Margin

FCF is an important metric to evaluate in SaaS businesses. I’m calculating FCF by taking the Operating Cash Flow and subtracting CapEx and Capitalized Software Costs.

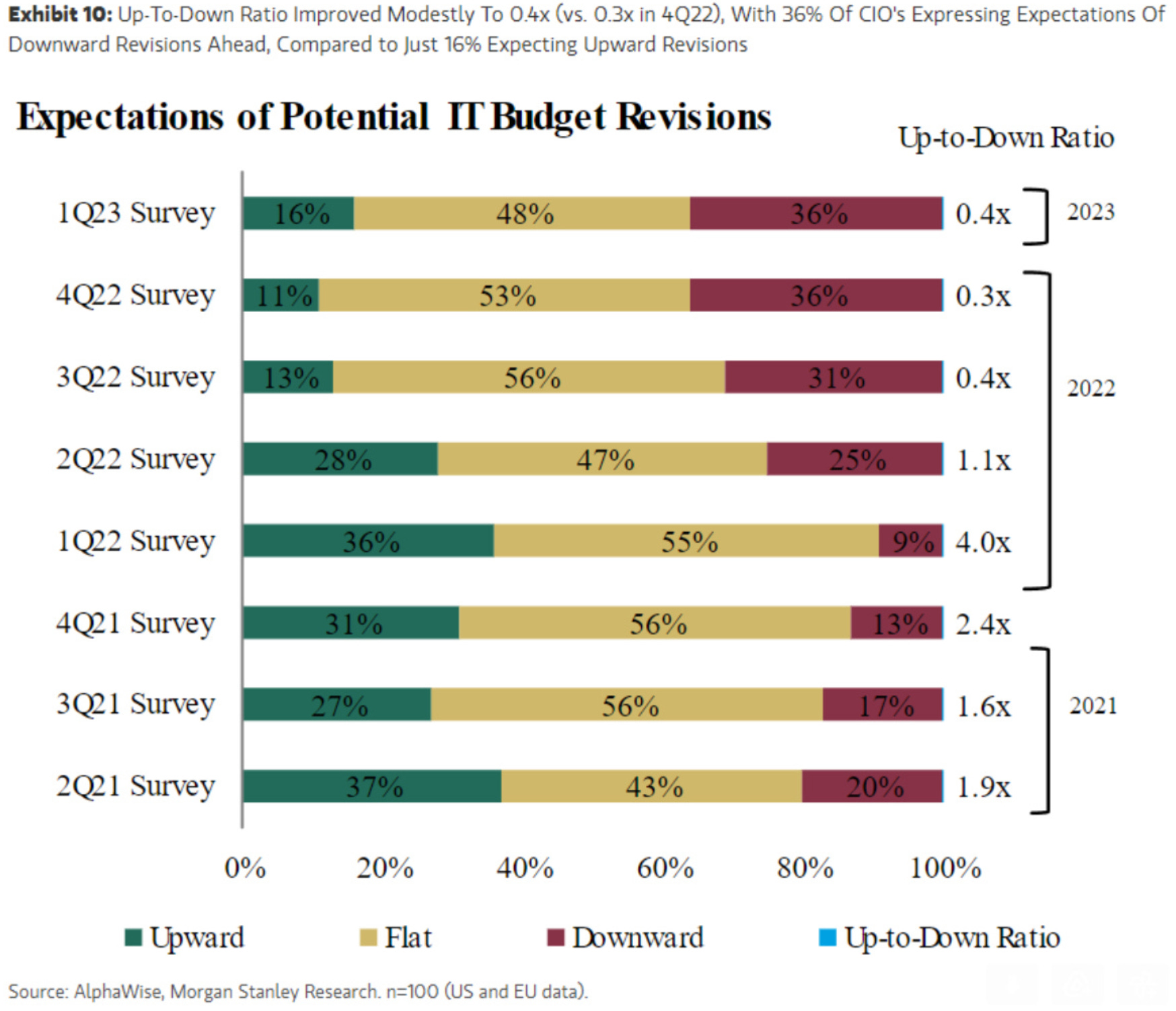

Net Revenue Retention ATTACH

Net Dollar Retention one of my favorite metrics to evaluate in private SaaS companies. calculated by taking the annual recurring revenue of a cohort of customers from 1 year ago, and comparing it to the current annual recurring revenue of that same set of customers (even if you experienced churn).

I generally classify anything >130% as best in class, 115% — 130% as good, and anything less than 115% as subpar.

Here’s the data from Q4:

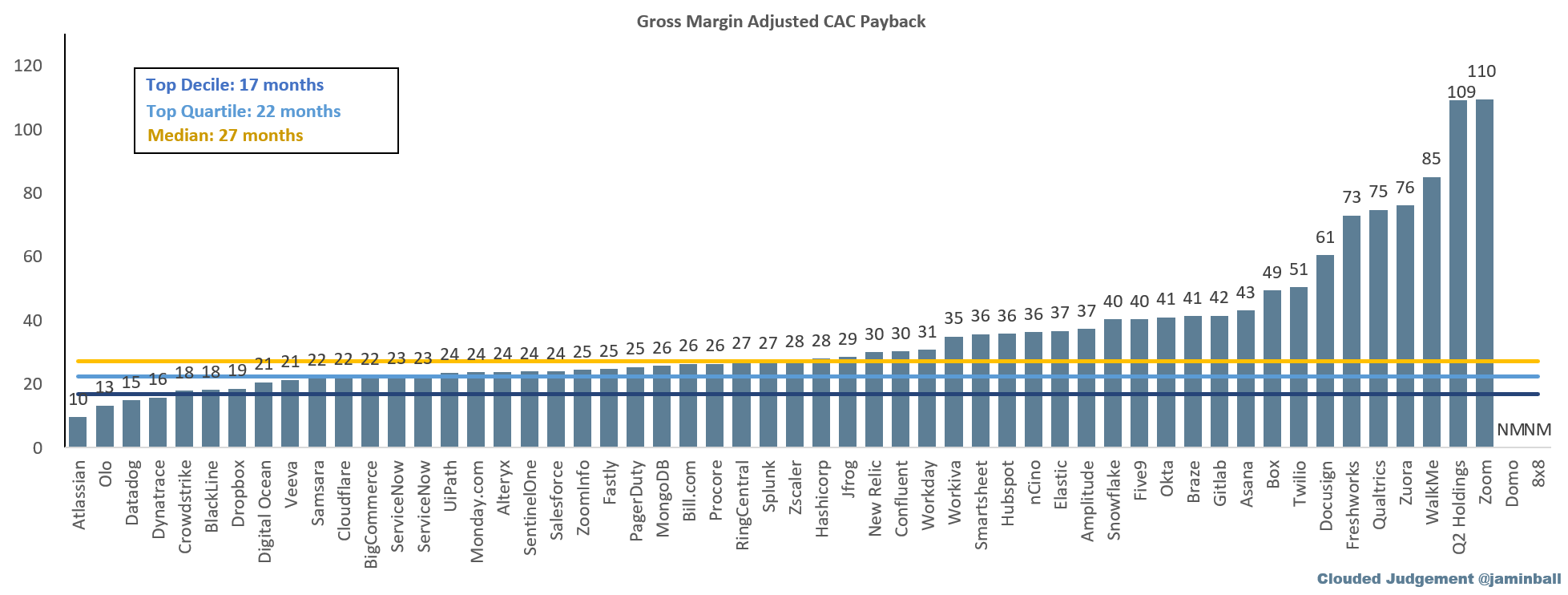

Sales Efficiency: Gross Margin Adjusted CAC Payback ATTACH

my second-favorite SaaS metric: Gross Margin Adjusted CAC Payback. You divide the previous quarter’s S&M expense (fully burdened CAC) by the net new ARR added in the current quarter (new logo ARR + Expansion - Churn - Contraction) multiplied by the gross margin. You then multiply this by 12 to get the number of months it takes to pay back CAC.

(Previous Q S&M) / (Net New ARR x Gross Margin) x 12

A simpler way to calculate net new ARR is by taking the current quarter’s ARR and subtracting the ending ARR from one quarter prior. Similar to net revenue retention, I’ve built up benchmarks to evaluate private companies’ performance.

I generally classify any payback <12 months as best in class, 12–24 months as good, and anything >24 months as subpar.

for public companies the formula to calculate gross margin adjusted payback is:

[(Previous Q S&M) / ((Current Q Subscription Rev x 4) -(Previous Q Subscription Rev x 4)) x Gross Margin] x 12

Change in 2023 Consensus Revenue Estimates

Change in Share Price

Wrapping Up ATTACH

#comment Monday.com 的 NDR 算是在中位数,但是 YoY Growth 出乎我的意料。 Monday.com 对标应该是 Asana + Atlassian, CRM 部分应该和 HubSpot 有竞争关系。这种大而全的产品应该都是中小企业为主吧。如果是小企业,那么目前小企业的情况来看,未来增长可能会放缓,可以关注下他们的招聘信息。

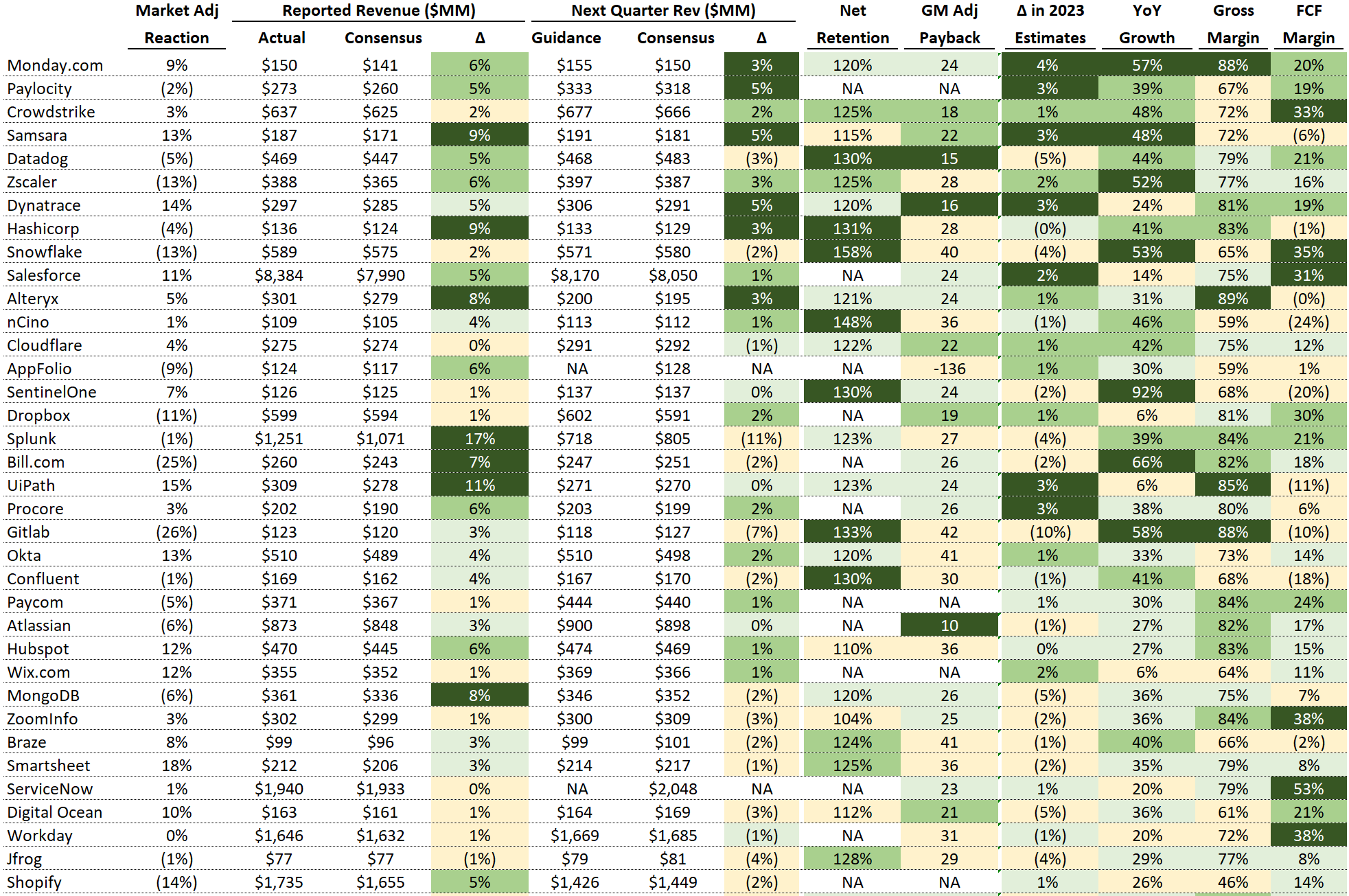

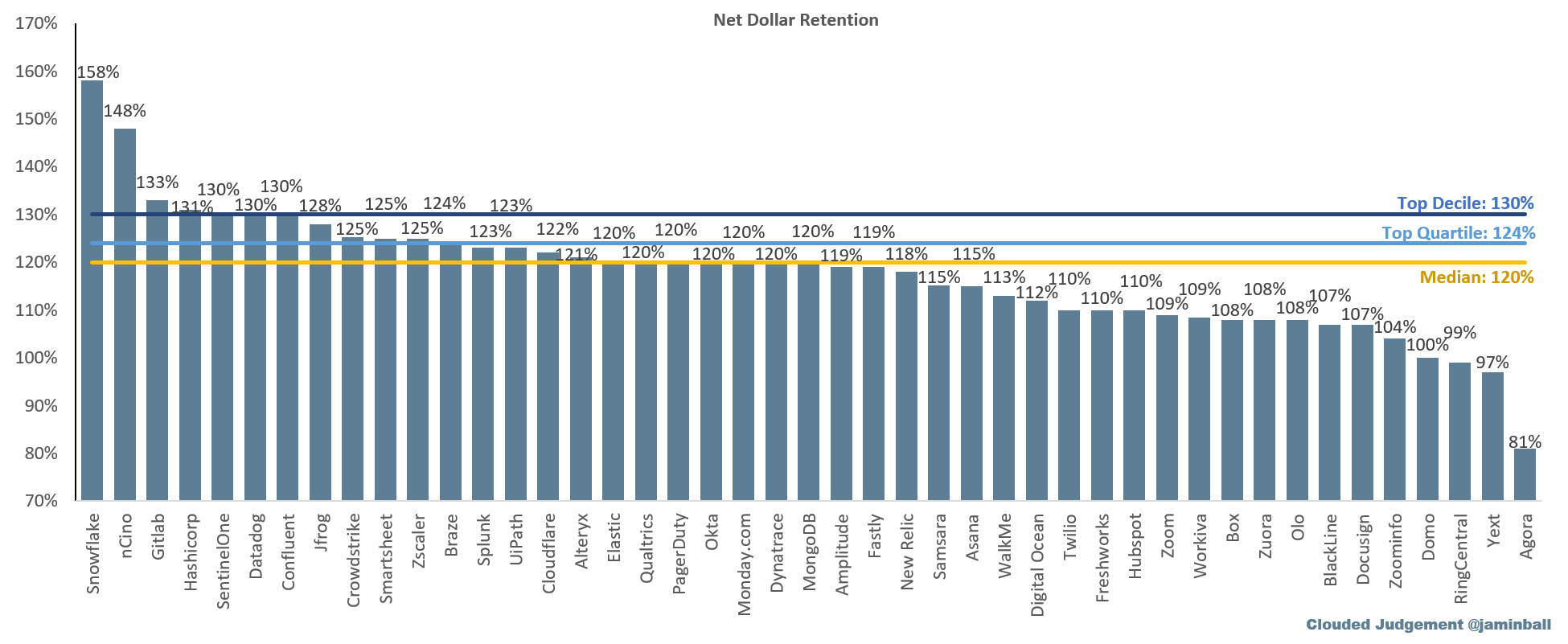

The Data ATTACH