Calendly: The $4B DocuSign of Scheduling

Just a feature ATTACH

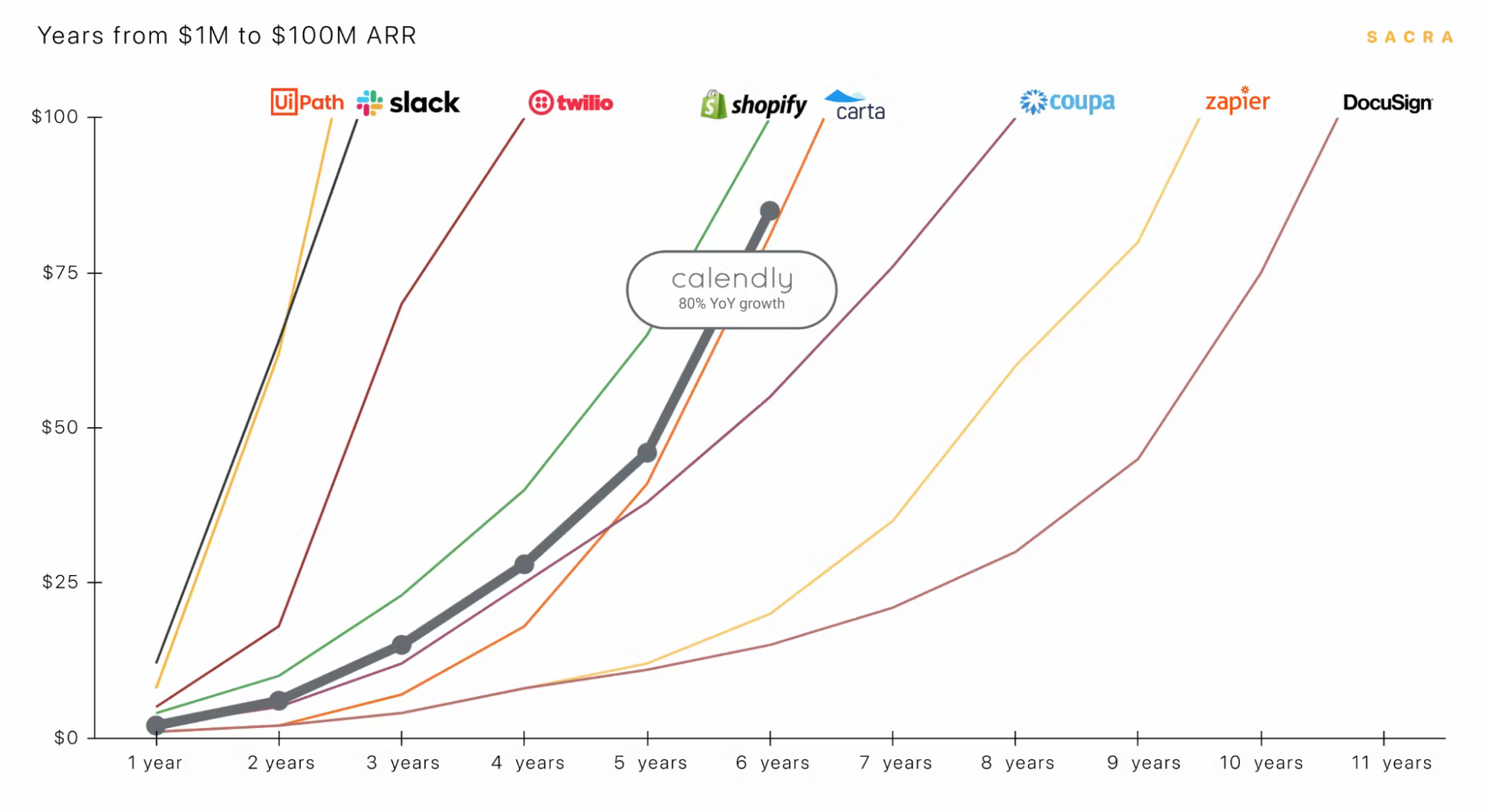

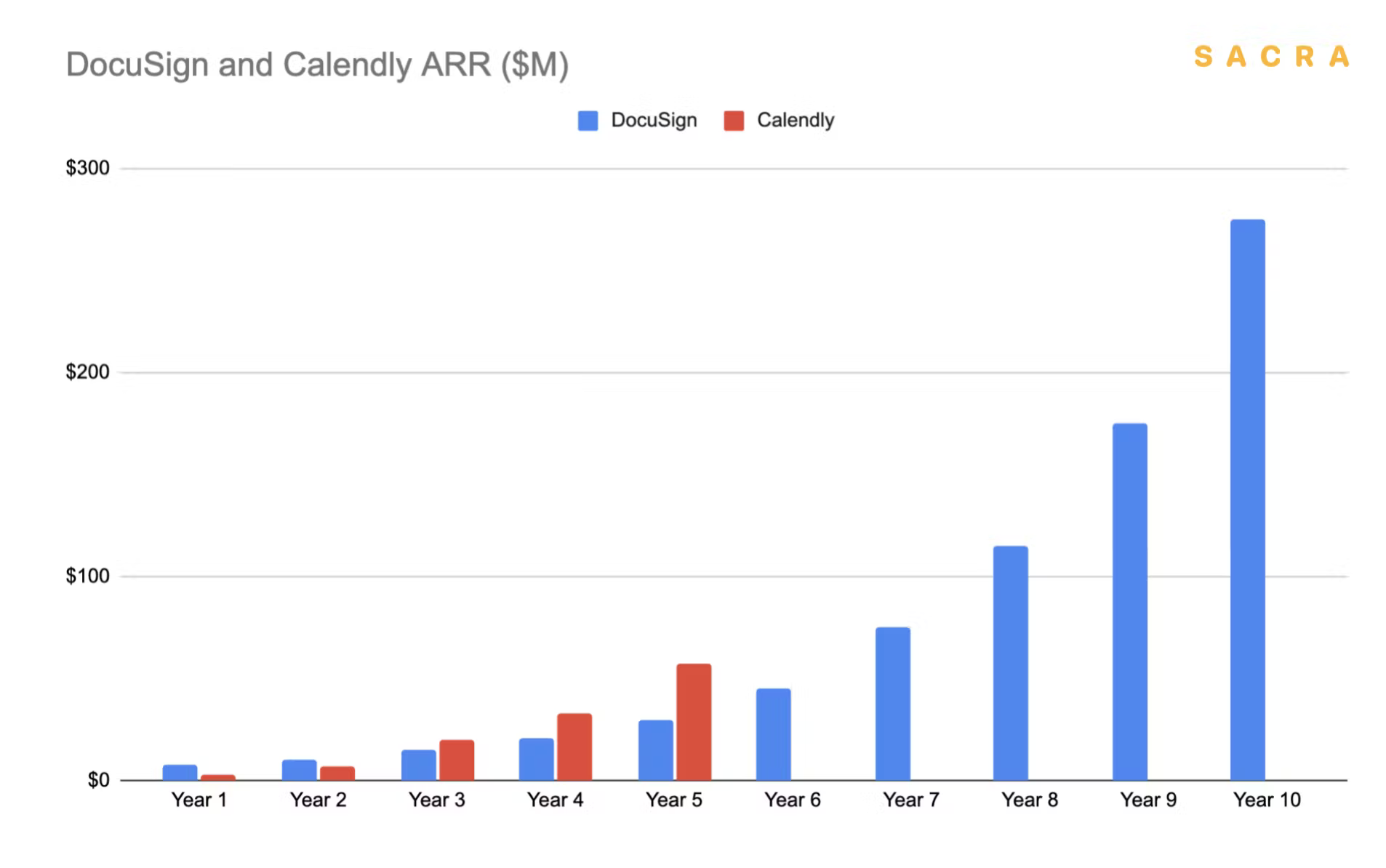

DocuSign had a powerful, organic growth loop and 70% share of a market that would go on to grow from $1M in size to $1B in just over a decade.

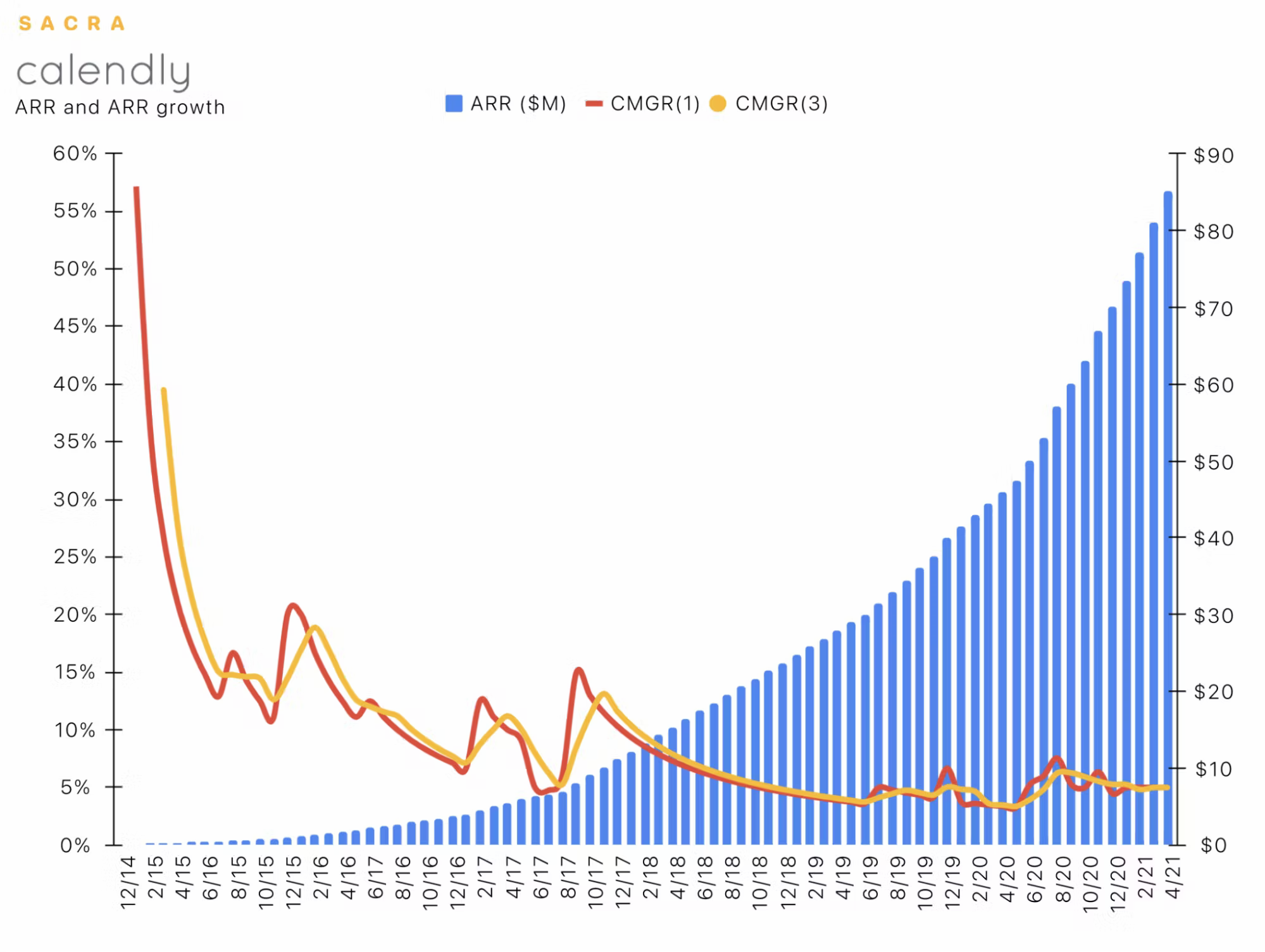

Calendly crossed $70M ARR at the beginning of the year, growing 75% year over year, and has more than 50% market share in the scheduling space.

Figure 1: Calendly is on track to hit $100M ARR by August 2021.

Calendly has—like DocuSign—spent the last seven years quietly and steadily building a SaaS juggernaut.

Key points

- Calendly is a SaaS scheduling product founded by CEO Tope Awotona, that launched in 2014. The majority of its usage comes from sales, customer success, marketing and recruiting teams that regularly schedule a high volume of meetings and want to remove friction from the process.

- COVID-19 has been a huge accelerator for Calendly’s business, with growth hitting 5-6% per month and revenues growing from $60M ARR last November to $70M ARR at the end of the year to about $85M ARR today.

- 50% YoY growth and increasing their enterprise revenue mix; low barriers to entry and high cost of customer acquisition erode Calendly’s product and growth advantages over time.

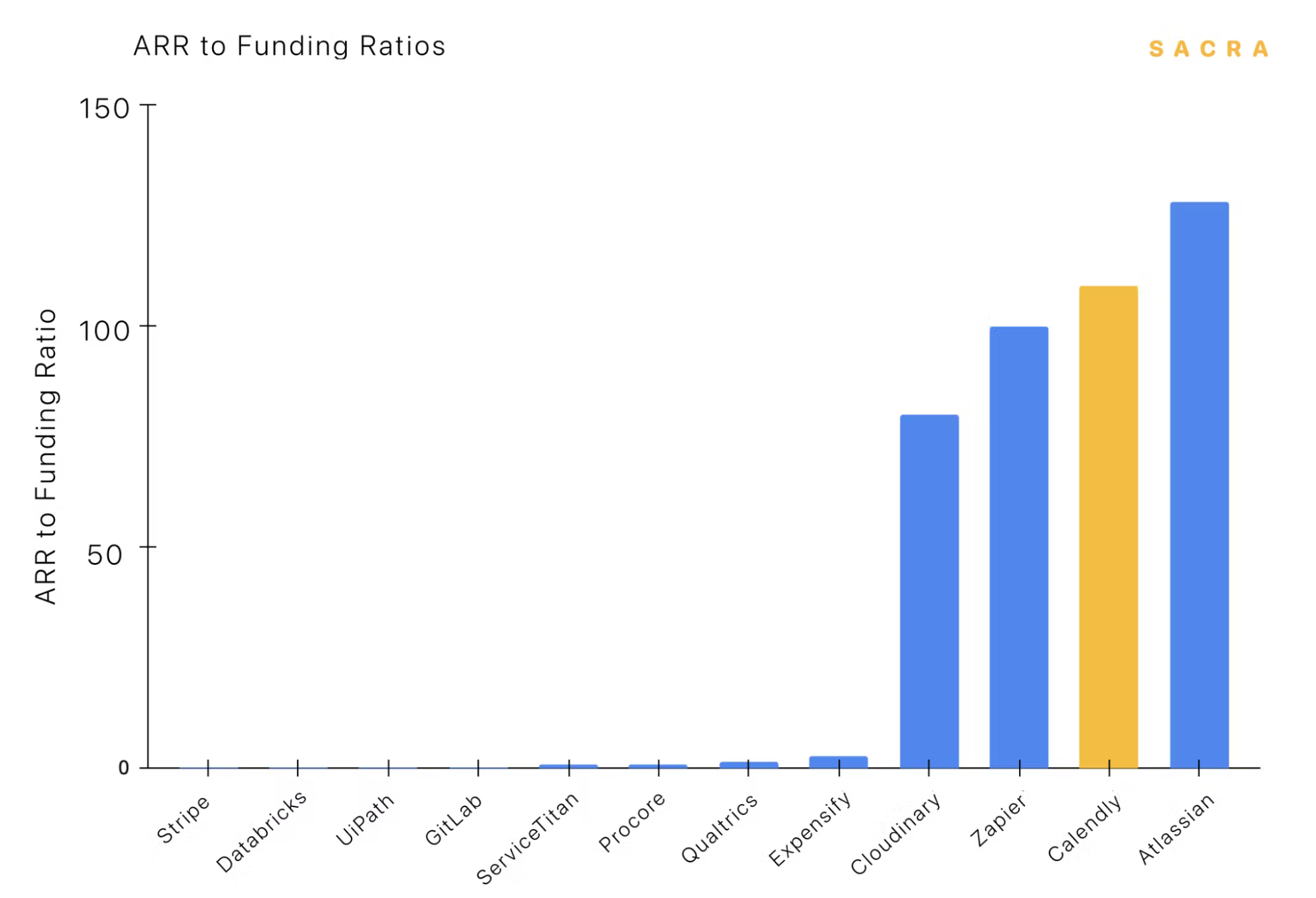

- Before their recent fundraise from OpenView, Calendly had raised just $550K en route to $60M ARR (109x multiple), making them only slightly less capital efficient than Atlassian (128x multiple) and even more efficient than Zapier (100x).

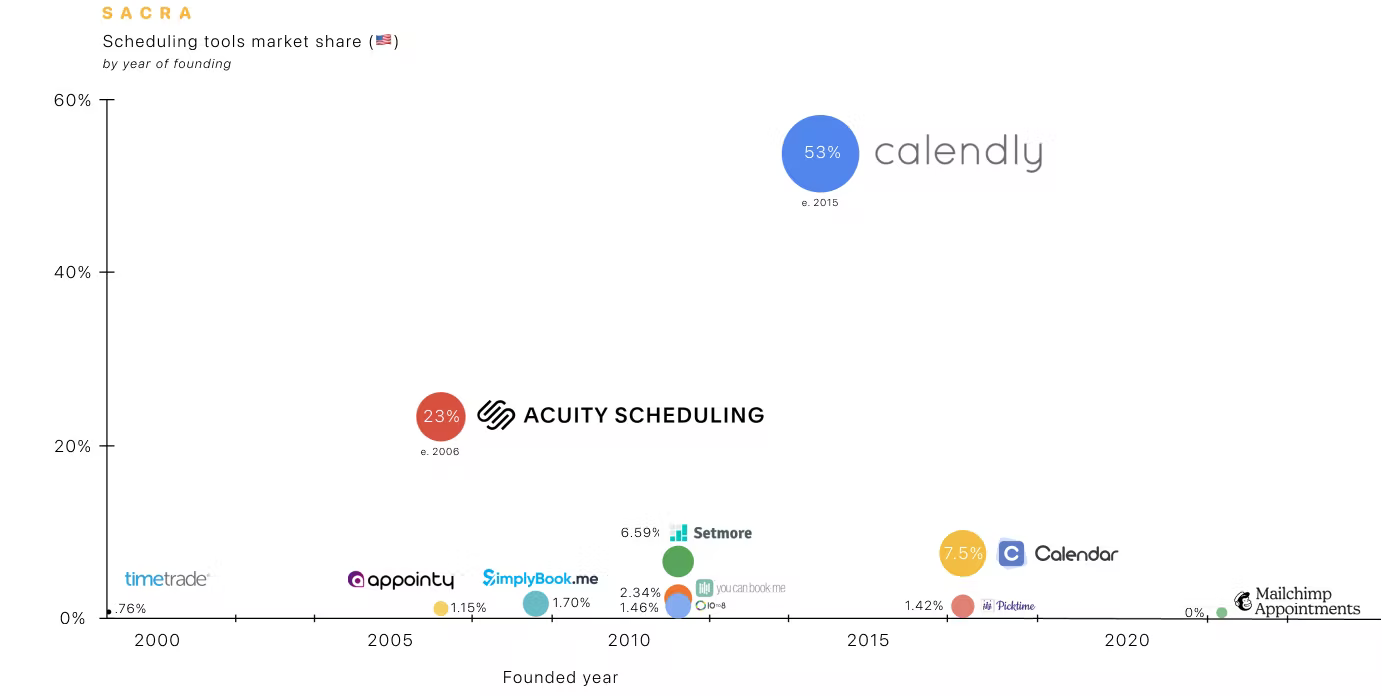

- Calendly has about 53% market share in the U.S. scheduling market

- acquire customers very cheaply via the organic sharing-based growth loop built into their product, there still aren’t meaningful network effects to having a Calendly account

- Deeper enterprise penetration means better retention (DocuSign has net dollar retention of 115%) and higher ARPU

- DocuSign grew from $100M ARR to $1B+ ARR by integrating “backwards” from e-signatures into the highly valuable enterprise contracting workflows adjacent to e-signatures. Today, Calendly has a parallel opportunity to leverage the atomic unit of the meeting to integrate backwards into sales, marketing, success and recruiting

一个是从电子签名向更高价值的企业合同市场拓展;Calendly 则是从会议预约向销售、市场以及猎头领域进军。

Valuation: Calendly is worth $4B ATTACH

we estimate Calendly is worth about $4.2B.

Figure 2: Calendly has nearly tripled ARR since June 2019, growing from $30M ARR to $85M ARR.

Figure 3: Calendly got to $60M ARR on $550,000 raised, putting them next to companies like Zapier and Atlassian on capital efficiency.

Product: The scheduling SaaS driving $85M ARR

Calendly’s paid plans are targeted primarily at sales, marketing, and customer success teams:

- pooled availability options for teams

- custom email notifications

- custom reminders

- SMS notifications

- branding

- integrations with tools like Stripe, Hubspot, and Intercom.

Analysis: Calendly’s path to becoming the DocuSign of scheduling ATTACH

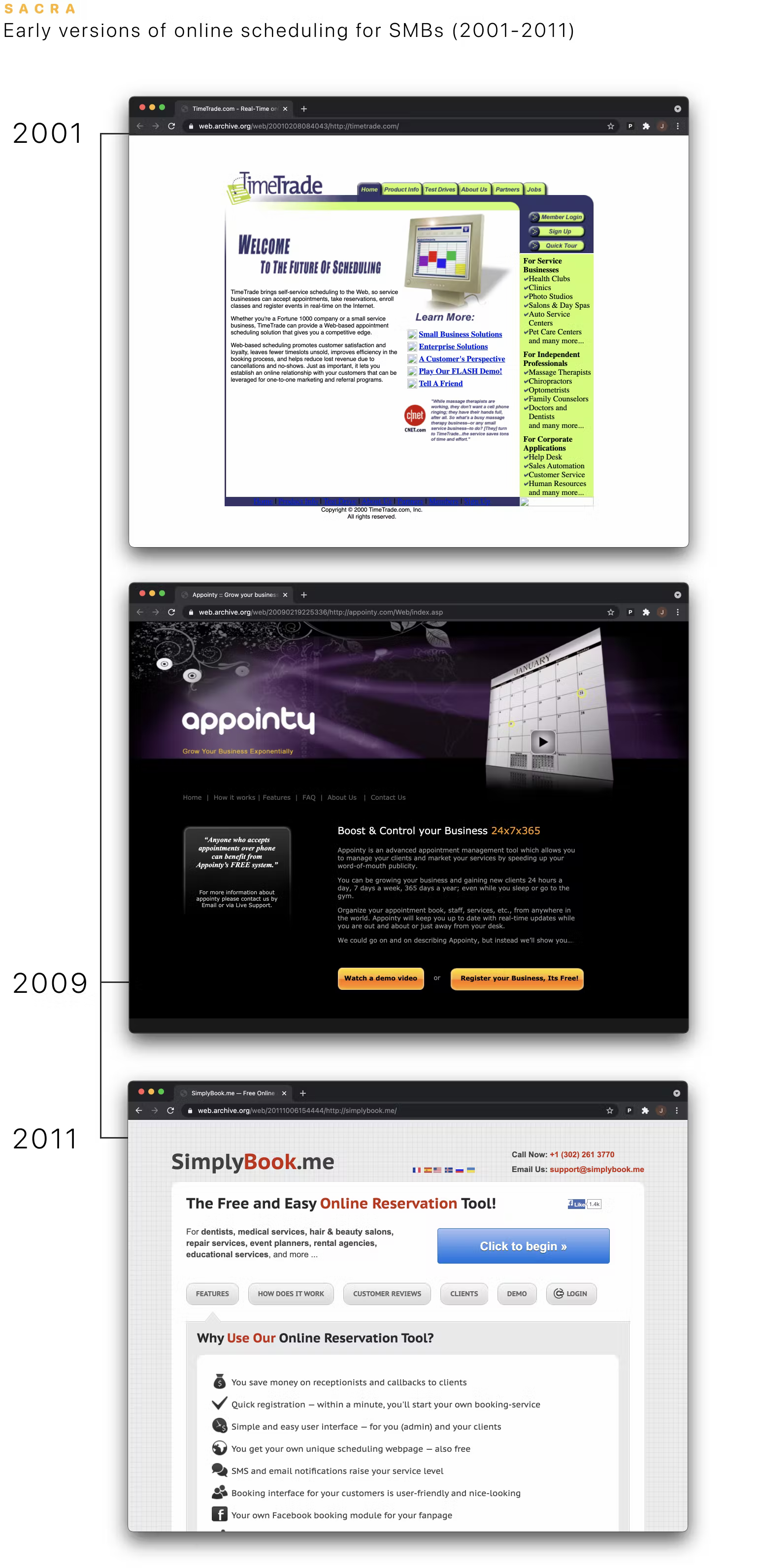

Figure 4: Early iterations of online scheduling were aimed squarely at brick-and-mortar SMBs and service businesses.

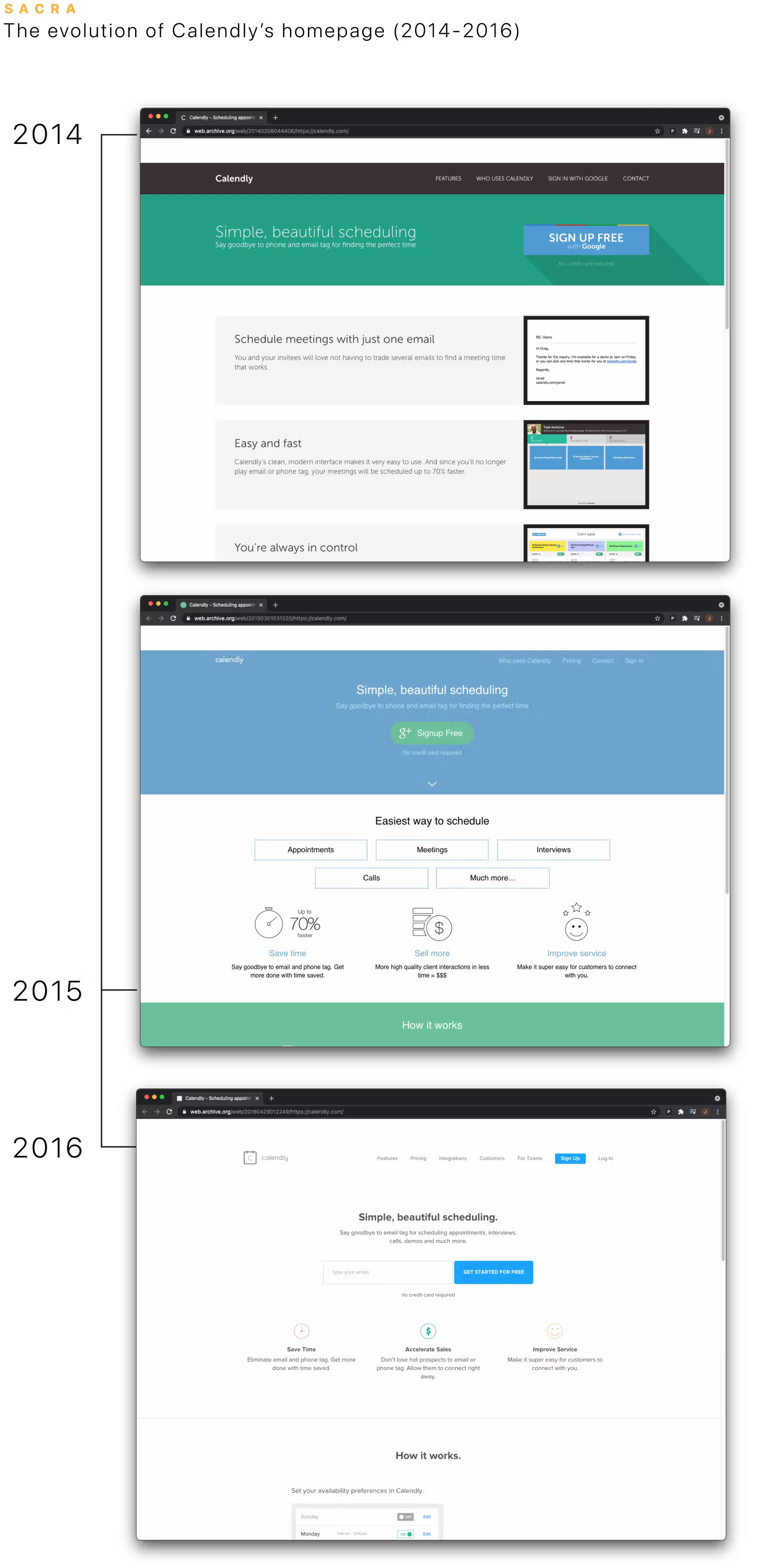

Figure 5: Calendly brought consumer style to scheduling, but also marketed its product to everyone who does business—not just service businesses and SMBs.

Calendly’s strategy of disrupting an existing market with a consumer-centric experience has given it the chance to break into the enterprise and disrupt an even bigger market from the bottom-up: sales, marketing and customer success management.

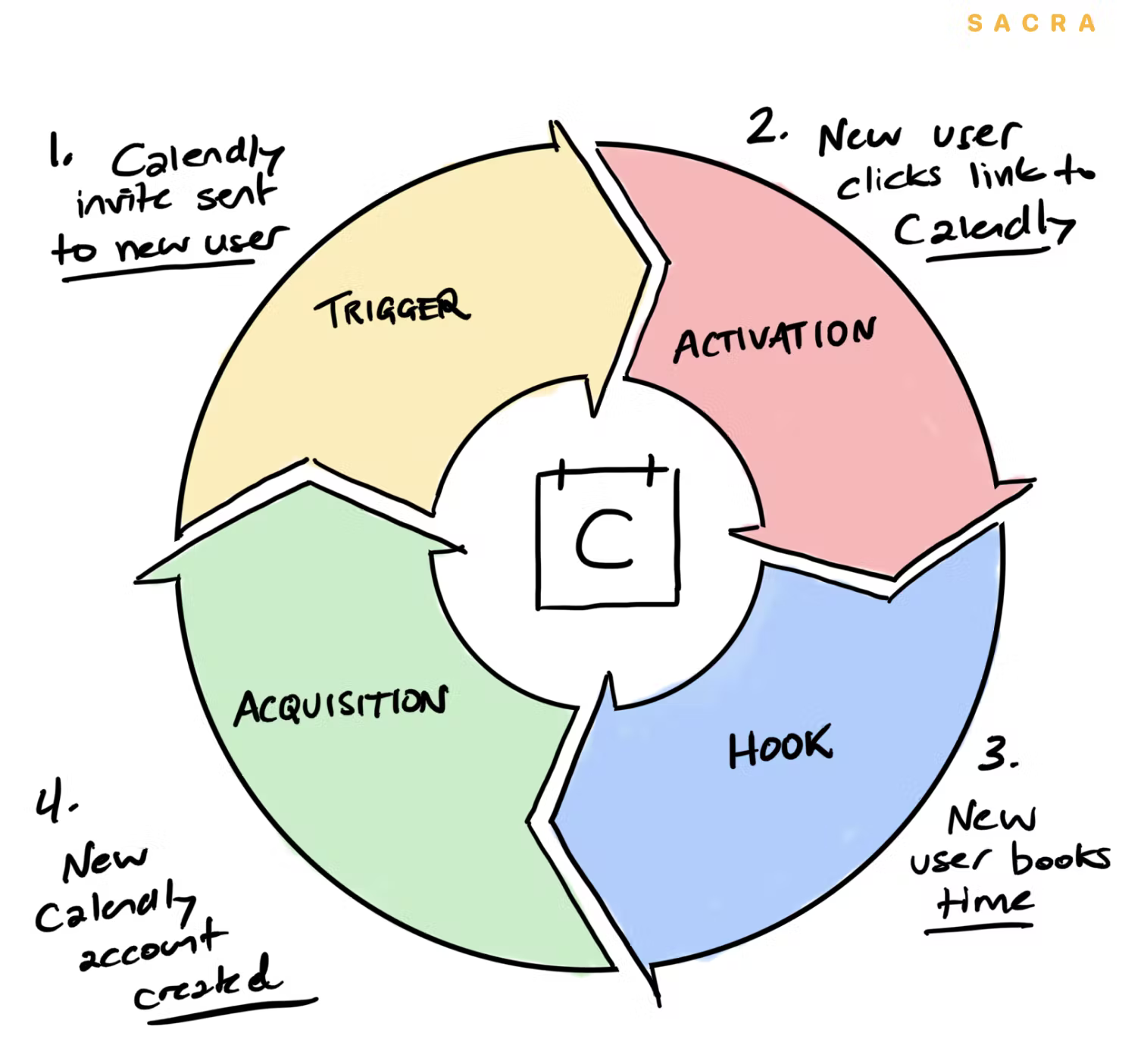

1. The growth loop that got Calendly to 10M users ATTACH

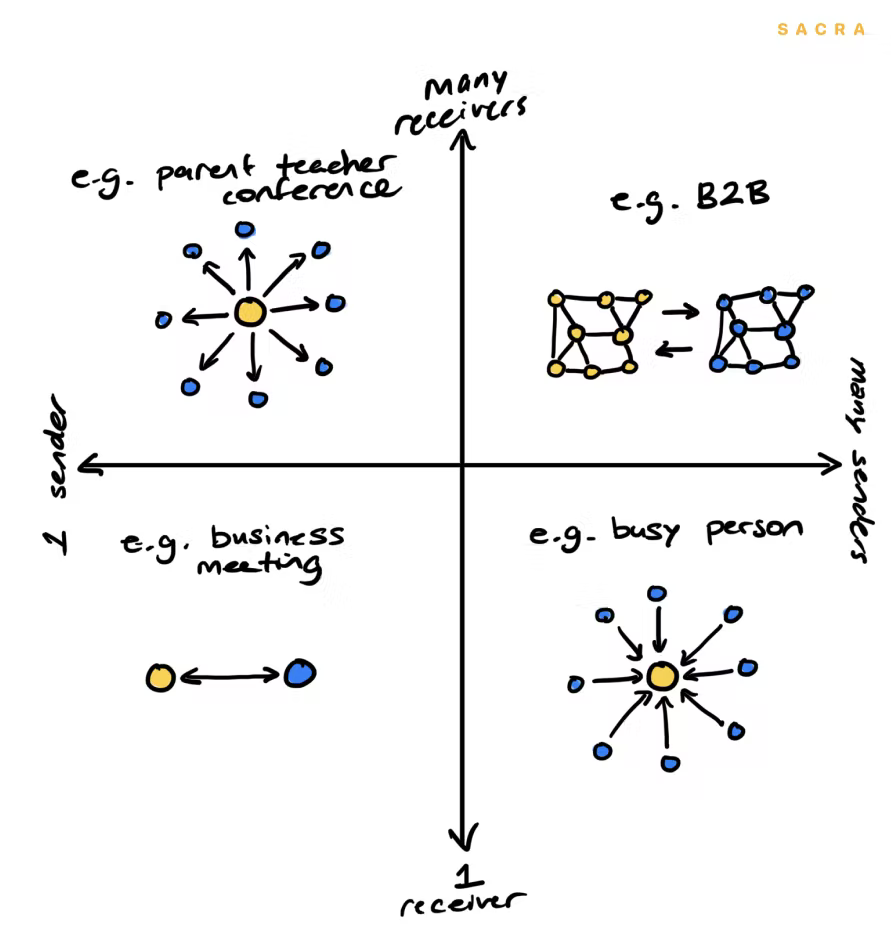

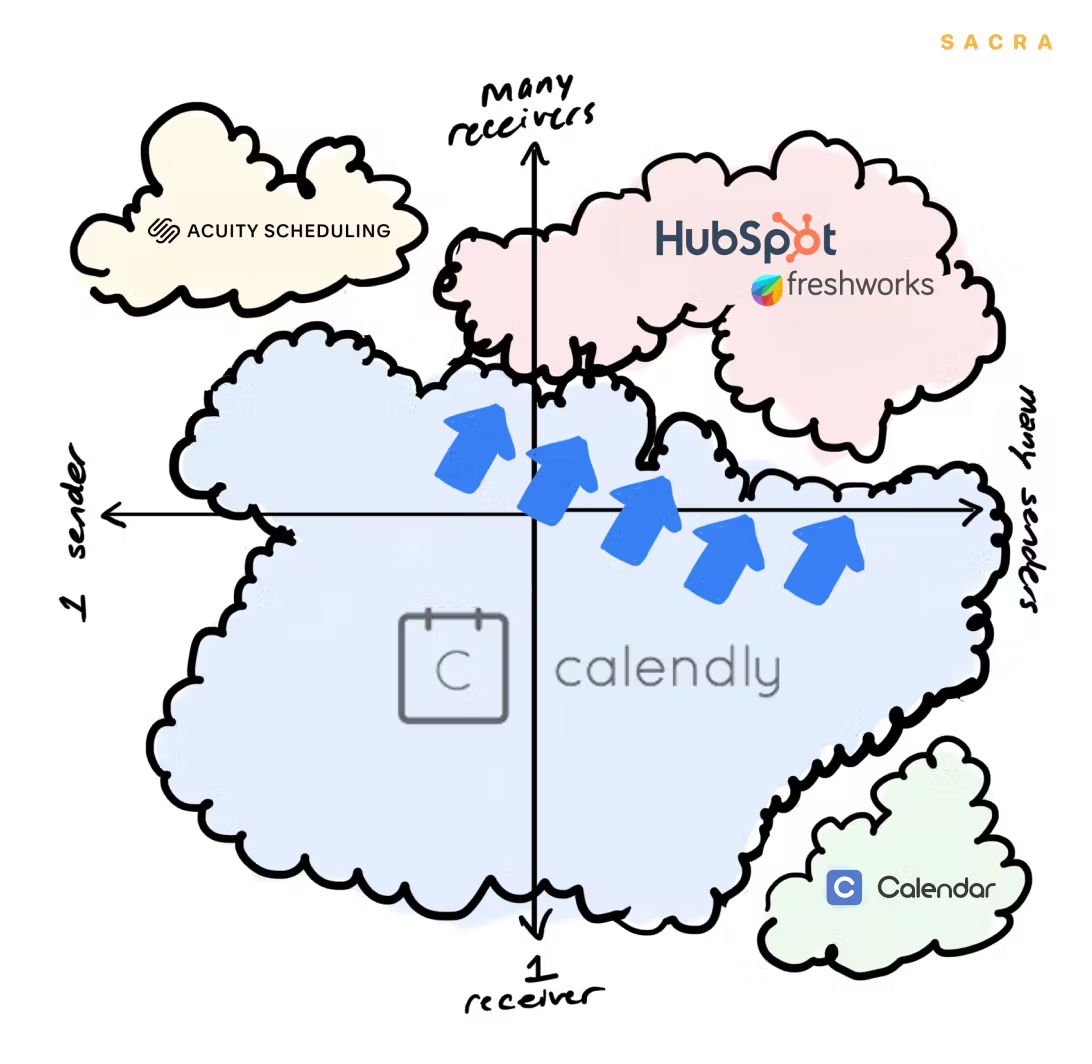

Figure 6: All of Calendly’s use cases can be organized according to whether there are 1 or many senders and receivers.

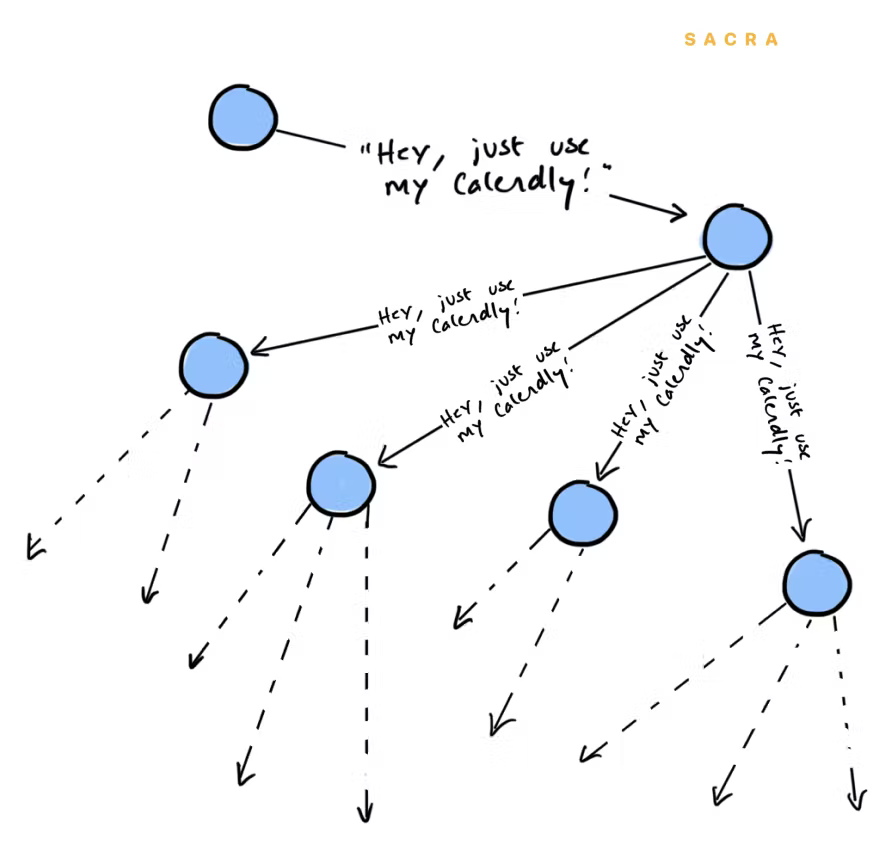

Calendly’s ability to cheaply acquire users through an organic growth loop embedded in their product—similar to DocuSign.

Figure 8: One Calendly user sends an invite to multiple other users, who then go on to do the same.

DocuSign’s loop centered around sending documents. When you send a document via DocuSign, it introduces all the recipients of that document to the product. They can see the DocuSign badge. They’re prompted to set up their own accounts to facilitate signing the document, and from there on they’re more likely to use the product when they need an e-signature.

this growth loop was bringing 130,000 new unique users to the product every day.

Calendly’s case, you send out a link to your calendar’s availability and then your recipient opens it, sees the Calendly badge, creates an invite through the product, and is reminded again about the product on the confirmation page.

Figure 9: DocuSign grew ARR at just 43% year-over-year through its first ten years—Calendly, once growing at a similar rate, saw heavily acceleration during COVID-19.

Figure 10: Today, Calendly has about 53% market share in the U.S. scheduling market. Click for bigger version.

Thanks to this growth loop, Calendly today has a 50%+ share of the market for scheduling. beating out the Squarespace-owned Acuity Scheduling

2. Why Calendly’s lack of network effect could be its downfall ATTACH

But there’s nothing proprietary about that loop, and no real network effects in the product—and few barriers to entry to stop another company from replicating Calendly’s path to success.

Calendly’s user Retention depends entirely on the strength of their brand and their product experience.

Calendly’s user Retention depends entirely on the strength of their brand and their product experience.

The other big competition for Calendly is sales and marketing suites like HubSpot, Freshworks and Drift. HubSpot and Drift bundle their scheduling workflows into their suite versus selling it as a stand-alone product, they also have the advantage of being able to offer it for free.

They are getting deeper and deeper into HubSpot and Drift’s territory—sales, success, marketing and recruiting workflows

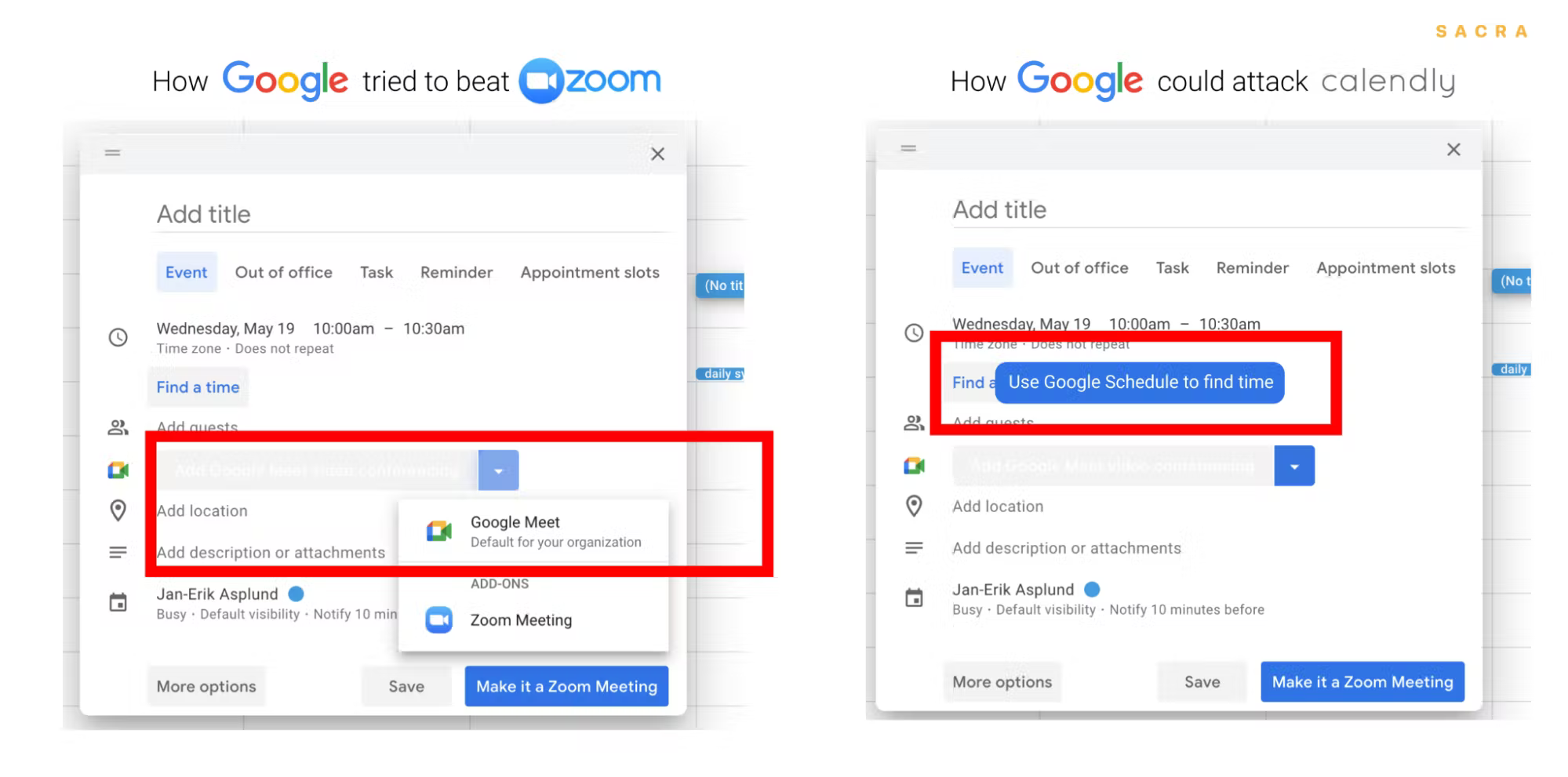

Google and Microsoft Outlook—who run the infrastructure below the majority of calendars managed on Calendly—could choose to enter this market

Figure 12: Google Calendar defaults to Google Meet when you try to add a video conferencing call to an event—a setting which can only be turned off by your GSuite administrator.