How Calendly will scale to $1B ARR

The aha moment Scheduling should work for the recipient, not the sender!

The first version of Calendly was developed in Ukraine and the company’s first customer was the customer success division of Bright Bytes - an analytics company in the education space. The first signs of a viral product surfaced when customer success reps at Bright Bytes used Calendly to schedule calls with parents

I ran out of budget - PLG virality to the rescue!

The PLG motion quickly took shape of a Growth flywheel, and alongside a frictionless self-serve product flow, the early sales team of 3 (led by Rachel Williams, Director Sales & Partnerships) was able to successfully upsell the premium (focused on customizability) and pro (focused on teams) offerings.

From $100M to $1B - what’s next for Calendly

2020-2021 early

- 2 CXO hirings - Patrick Moran (CRO, ex-Quip CMO) & Jeff Diana (CPO, ex-Atlassian CPO)

- Launch of Calendly enterprise

- Series B fundraise of $350M at a $3B valuation (led by Openview partners)

Building the Sales machinery - Managing lead flow, using PQLs, and people ATTACH

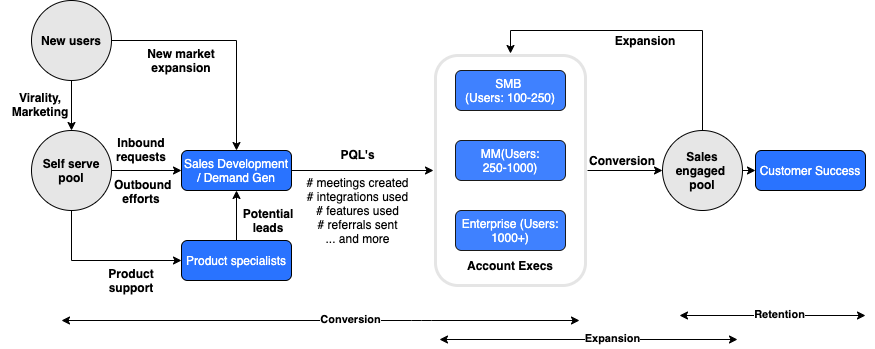

Calendly had to layer its self-serve process with Product-Led Sales. The new GTM of Calendly focuses on optimization of Leads flow, usage of PQL, segementation.

Lead flow:

- Lead discovery is led by the sales development team

- PQL’s are passed on to a segmented account executive (AE) team

- The principle of land & expand, and an emphasis on continuity further tasks the AE with expansion

- Customer success sits at the bottom of the funnel with the core objective of churn reduction and customer delight.

- Calendly also invests heavily in product marketing, building customer stories around the tool’s multi-industry, multi-scale use-cases!

Figure 1: Lead flow and workflow segmentation @ Calendly

PQL’s: The sales development team, powered by data and tools now qualify leads based on:

- Account information: Team size, industry, geography, etc.

- Usage signals: #meetings created, #integrations used, time spent in the system, features used, referrals for teammates, etc.

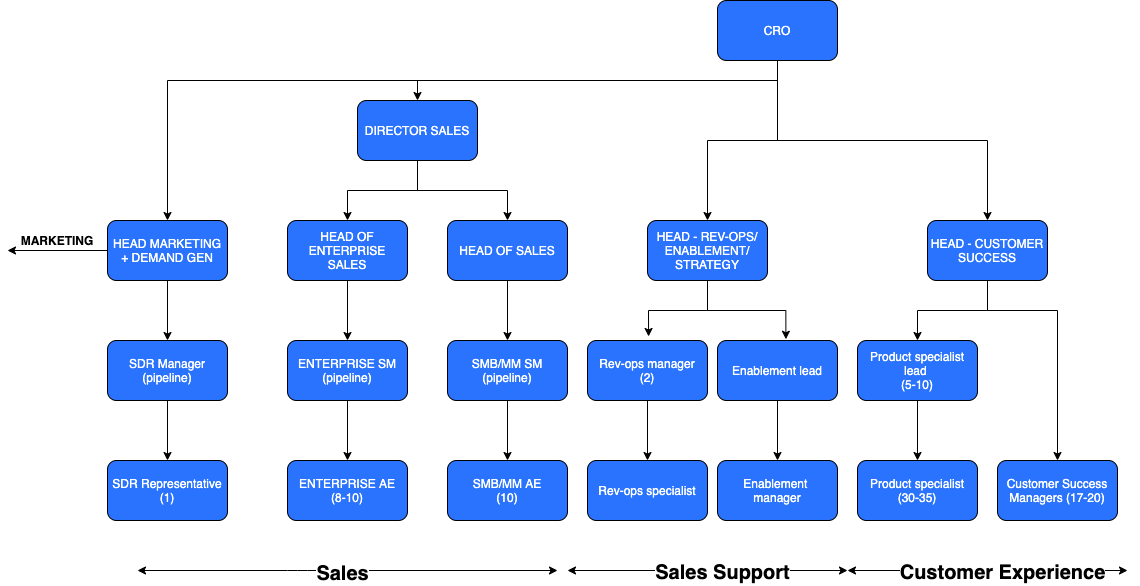

Team: This streamlining of processes and a need to accommodate the volume and scale of high-velocity + strategic sales warranted more resources and boy

Figure 2: Sales org at Calendly

Way forward

Calendly’s (arguable) 50% market share in the US scheduling market can be attributed to its dominance in the B2C and C2C segments.