Building a Growth Framework Towards a $100 Million Product

About ATTACH

Four Fits framework:

- Product-Market Fit: how to lay out your Market and Product hypotheses, and how understanding whether you have Market Product Fit comes down to Qualitative, Quantitative, and Intuitive indicators.

- Product-Channel Fit: the concept that products are built to fit channels, channels are not built to fit products.

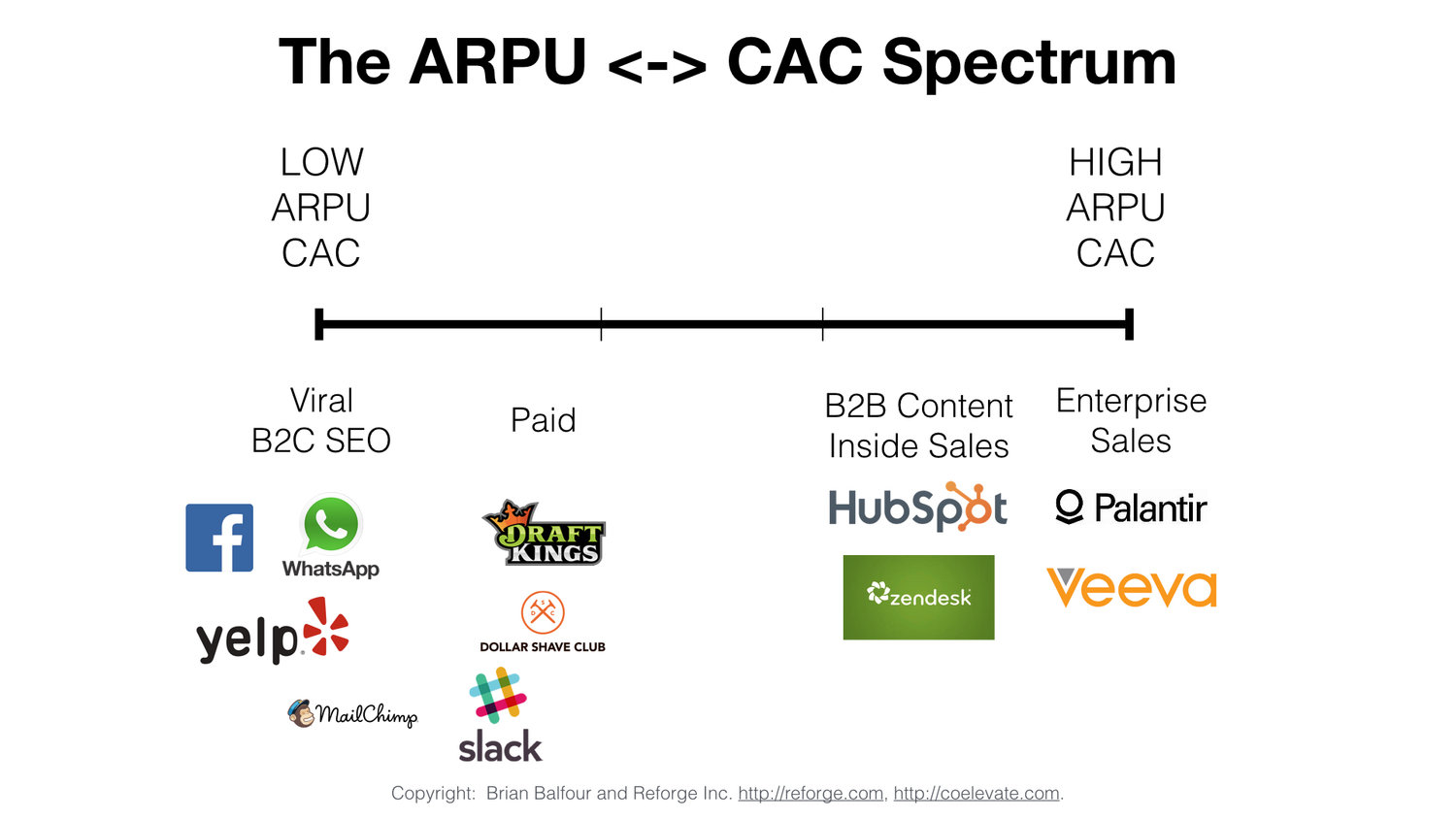

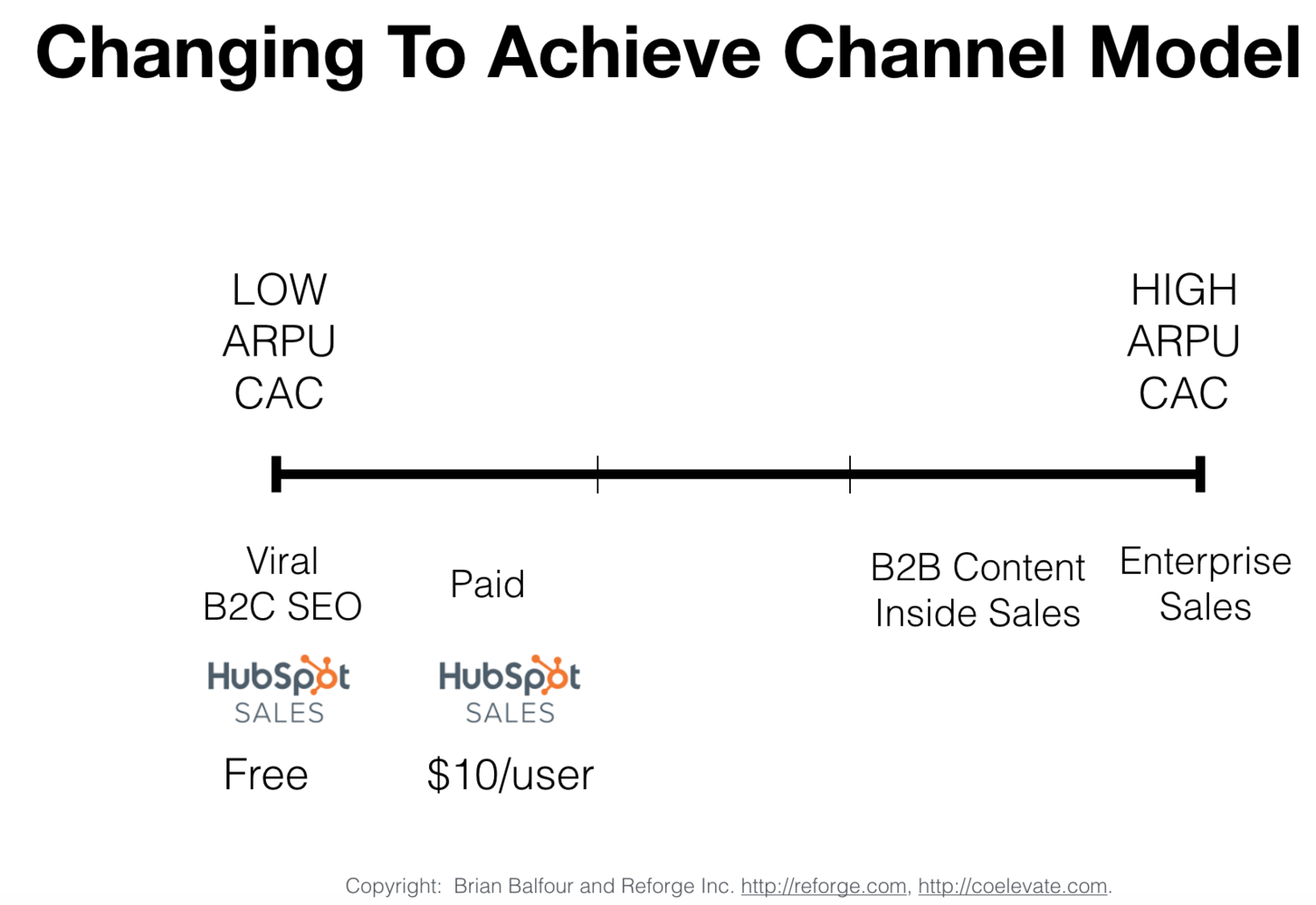

- Channel-Model Fit: which explains how channels are determined by your model. I went through the ARPU ↔ CAC spectrum and how your product and product tiers need to align on this spectrum.

- Model-Market Fit: how your model influences the target market and vice versa.

Phase One: The Beginning - Market Product Fit ATTACH

The road to $100M doesn’t start with product You are starting with the solution, and then trying to fit it to the problem.

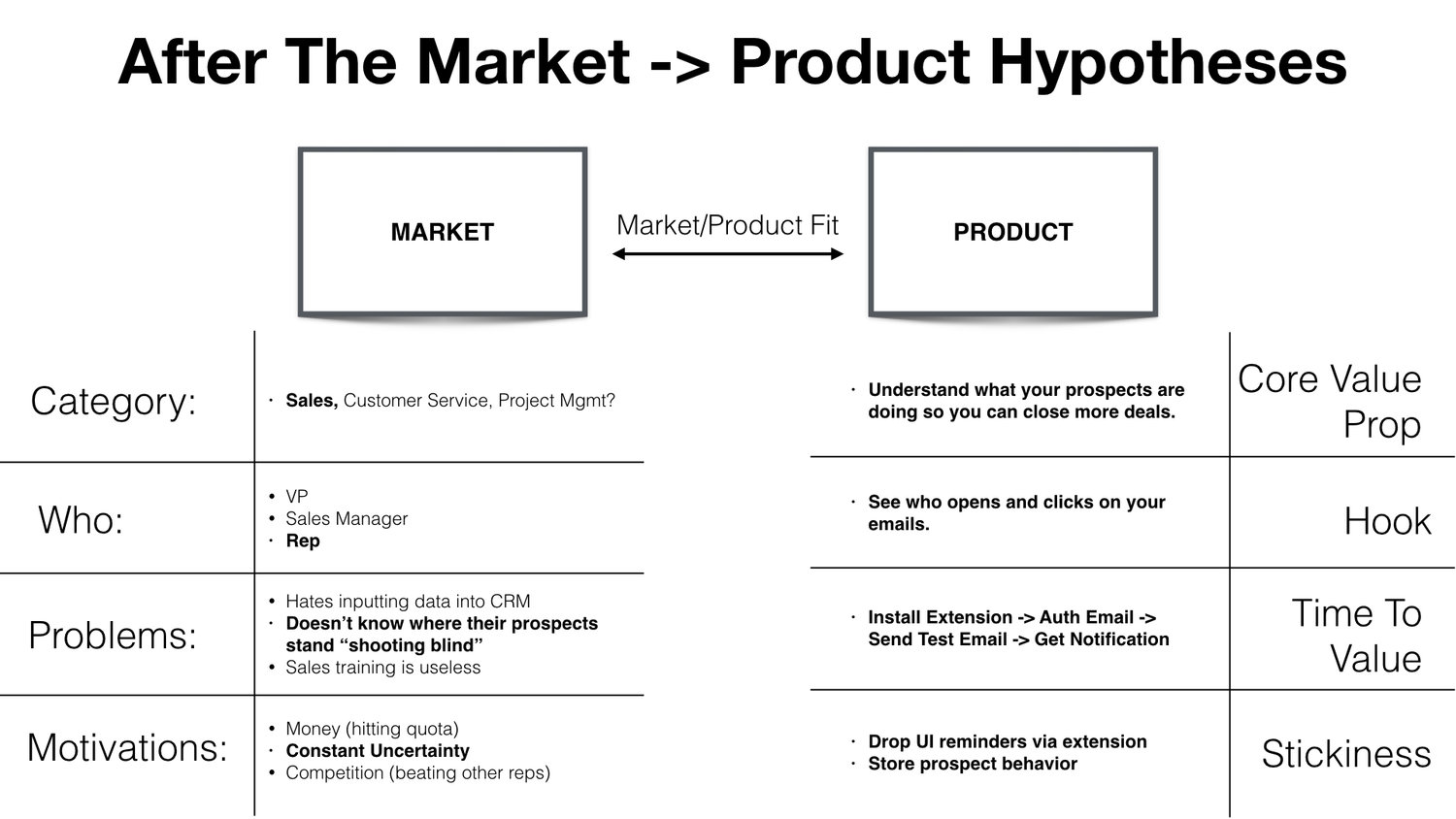

During my first two weeks at HubSpot, We built out detailed Persona, but the four main things we defined were:

- *Category*. What category of products does the customer put you in?

- *Who*. Who is the target audience within the category? There are always multiple personas within a single category, so this breaks it down further.

- *Problems*. What problems does your target audience have related to the category?

- *Motivations*. What are the motivations behind those problems? Why are those problems important to your target audience?

HubSpot Sales looked like this:

- Category. Sales Software.

- Who. The individual contributor. There were also two sub-types of ICs: SDRs and Account Reps.

- Problem. Not knowing where a prospect or client stood in the process.

- Motivation. A couple of motivations: 1) Money. Knowing where a prospect was led to better prioritization and selling, which led to more closing. 2) Uncertainty. The target audience’s life was filled with constant uncertainty. Relieving that uncertainty was a big deal.

Our Market Product Fit Hypotheses looked like this:

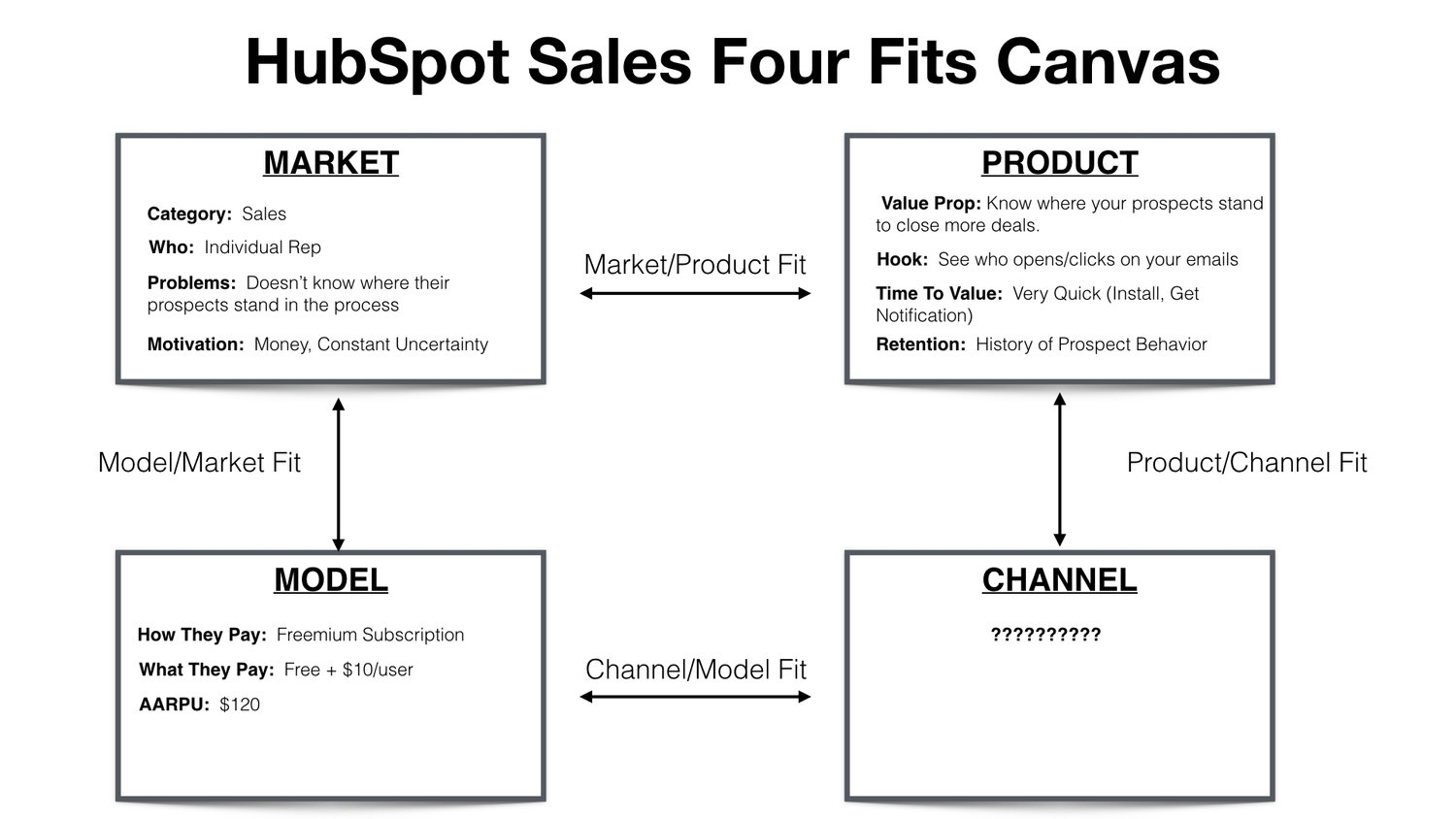

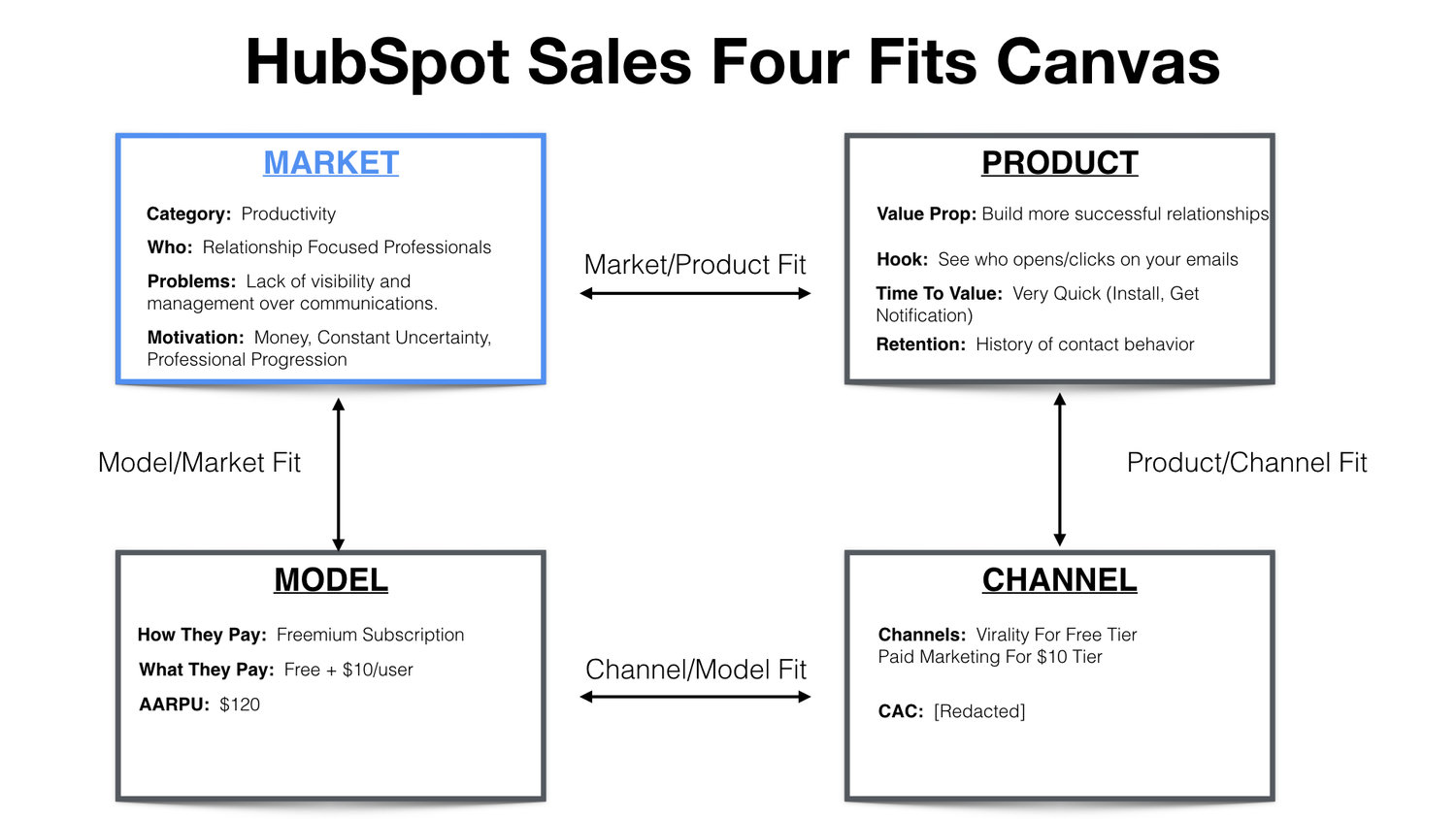

At this point our four fits canvas looked something similar to this:

Phase Two: Finding Product <> Channel Fit and Channel <> Model Fit ATTACH

Product Channel Fit will make or break your growth. Product-Market Fit states that: “Products are built to fit with channels. Channels do not mold to products. The reason for this is that you do not define the rules of the channel. You define your product, but the channel defines the rules of the channel. “

Our product had a few elements:

- Very Quick Time to Value

- Simple Hook

- Broad Value Prop

- Transactional Model

These elements of the product led to building two main channel hypotheses:

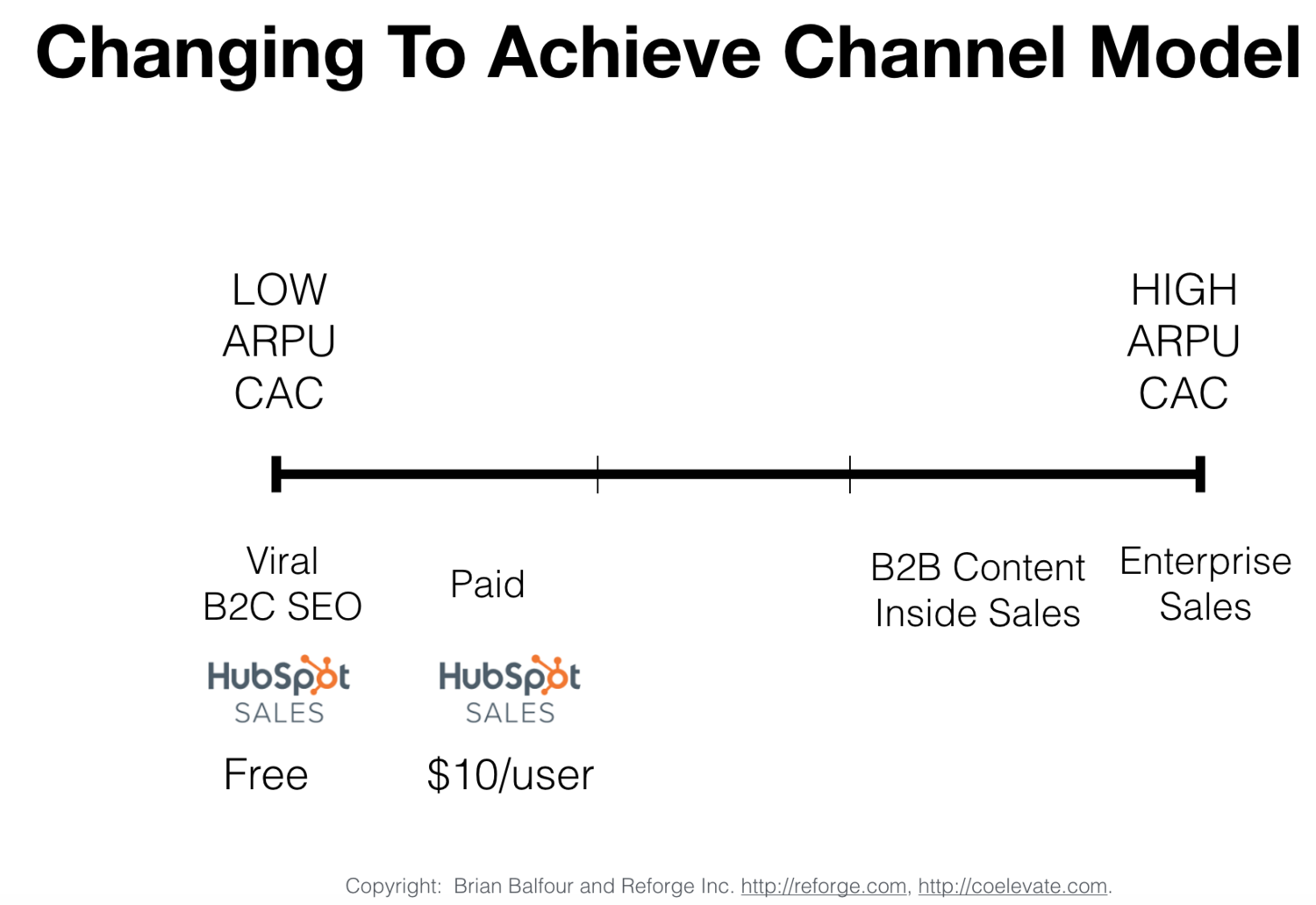

Changing To Achieve Channel Model ATTACH

They did indeed. Virality fit with our free tier (no ARPU, low friction). Paid Marketing fit with our $10/user tier which had higher friction but higher ARPU to support the channel.

Once we laid out these hypotheses we spent the next few months proving them out, and thankfully we were correct.

Phase Three: Revisiting Target Audience, Model Market Fit ATTACH

To review for a moment, Model Market Fit states: ARPU x Total Customers In Market x % You Think You Can Capture >= $100M

The issue was that there are only 2-3 million salespeople in the target market if you take out brick and mortar retail salespeople and outside salespeople, who weren’t a good fit for our product. At our $120 ARPU we would have needed 1 million paying customers (or 33% - 50% of the target market), which also meant we needed to acquire 10 million+ free users, given our conversion rates. Those numbers didn’t feel reasonable for our current definition of the market.

We redefined our Market hypotheses

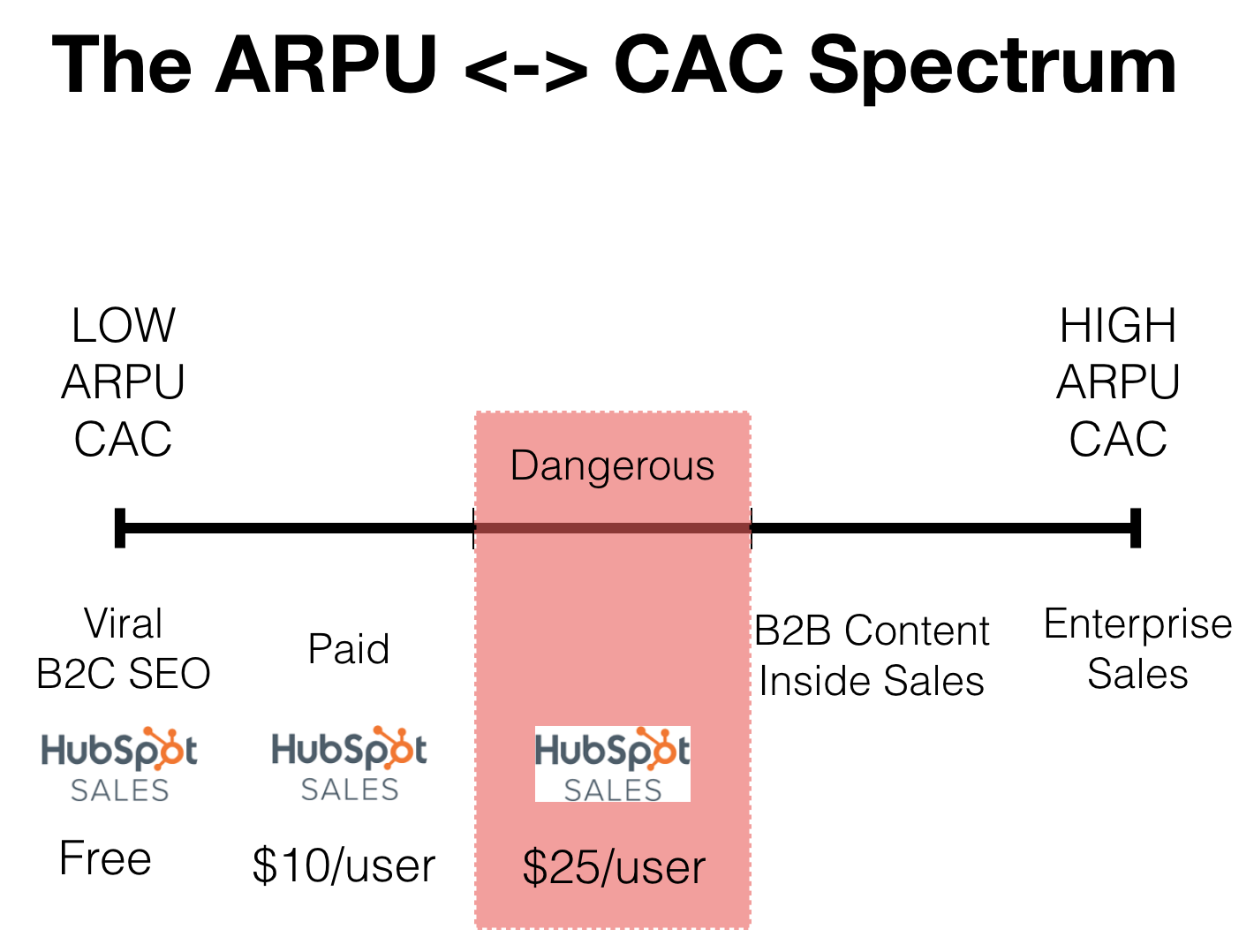

Phase Four: Introducing A New Tier, Lack Of Channel Model Fit ATTACH

Talking to our paying customers, there was clearly a large segment that had a higher willingness to pay. We started exploring additional features and introduced a new tier to the product priced at $25/month.

The $25/user/month price point created too much friction to effectively drive with the lower CAC channels of virality and paid that were working on the free and $10 tier.

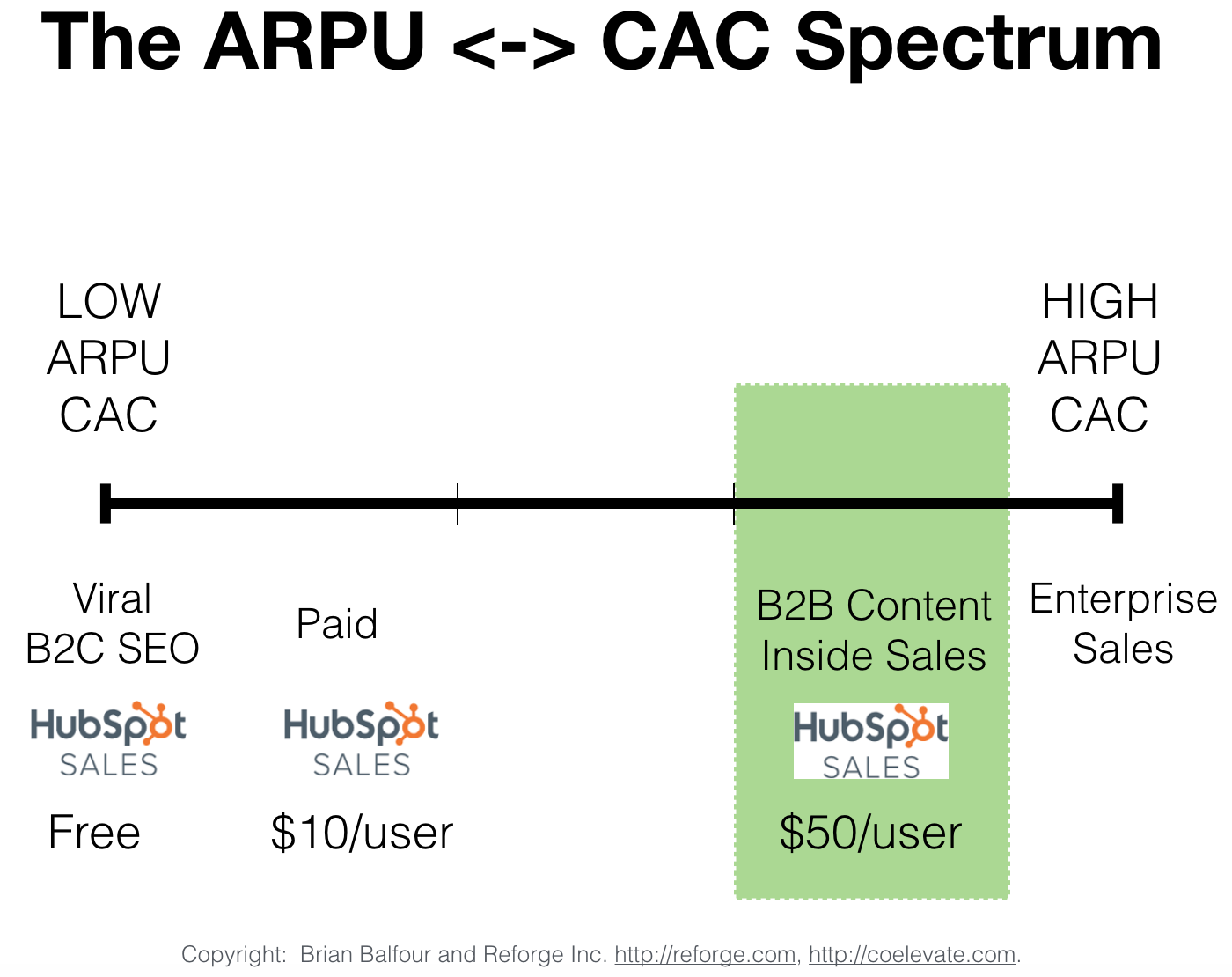

As a result, we eliminated the $25 tier and created a $50 per user per month tier, adding an additional feature or two to the product.

Phase Five: Strategy Shift, Changing Everything ATTACH

Our mission for HubSpot Sales had been to build a $100M line of product with a freemium model. To do that, we had a lower ARPU and to achieve model market fit needed to target a broader audience, which included a lot of small businesses and business owners.

There were really only two choices:

- Choose The Model - Decide we wanted to keep the freemium, low friction, touchless, and low arpu model, and embrace a different type of market veering away from the core mid market customer that HubSpot had seen so much success with.

- Choose The Market - Decide we wanted to focus on the mid market customer.

A number of strategic shifts fell out of that:

- Product - We cut the $10 tier and moved those features to the $50 tier. In addition we doubled down on additional features within the $50 tier targeted at the problems of our new market definition.

- Channels - We massively reduced efforts on virality and paid, and doubled down on content marketing and sales to align Product/Channel Fit.

- Model - We doubled down on the $50 tier selling minimum seat, annual deals, which increased the ARPU to align Channel Model Fit and Model Market Fit.

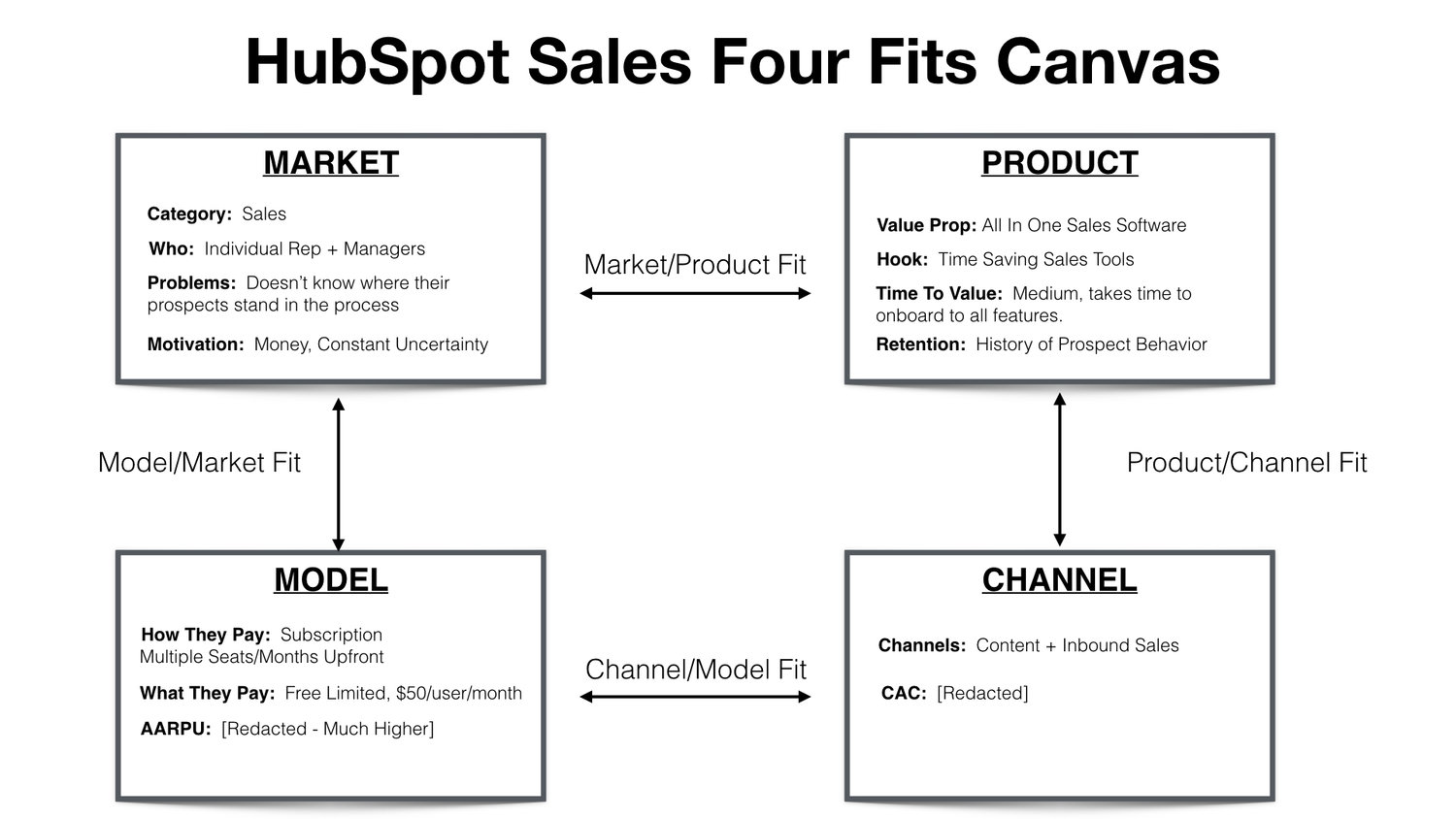

The new fit canvas looked like this:

My Takeaways

Beyond coming up with the Four Fits Framework, I took away a number of lessons:

- You need all four fits to align to be able to grow into a $100M+ company in a venture backed timeframe.

- When you change one component within the framework, you need to revisit and change the rest,

- The fits are always changing and evolving.

- If you are building a new line of business inside a larger company, like we were at HubSpot, you should avoid pursuing a path where all the components of the framework are different than those of the existing core business.