SaaS Metrics 2.0 – A Guide to Measuring and Improving what Matters

Intro

“If you cannot measure it, you cannot improve it” – Lord Kelvin actually it’s Peter Drucker

In the SaaS world, there are a few key variables that make a big difference to future results.

The goal of the article is to help you answer the following questions:

- Is my business financially viable?

- What is working well, and what needs to be improved?

- What levers should management focus on to drive the business?

- Should the CEO hit the accelerator, or the brakes?

- What is the impact on cash and profit/loss of hitting the accelerator?

What’s so different about SaaS?

different because the revenue for the service comes over an extended period of time (the customer lifetime).

Churn quickly, and the business will likely lose money on the investment that they made to acquire that customer CAC.

there are now two sales that have to be accomplished:

- Acquiring the customer

- Keeping the customer (to maximize the lifetime value).

The 3 Keys to Success in SaaS:

- Acquiring Customers CAC

- Retaining Customers Customer Retention

- Monetizing Customers Monetization

The SaaS P&L / Cash Flow Trough

investors expect that the losses / cash drain should narrow, right? Instead, this is the perfect time to increase investment in the business. which will cause losses to deepen again.

Why is growth important?

as soon as the business has shown that it can succeed, it should invest aggressively to increase the growth rate.

SaaS is usually a “winner-takes-all” game, and it is therefore important to grab market share as fast as possible to make sure you are the winner in your space.

A Powerful Tool: Unit Economics

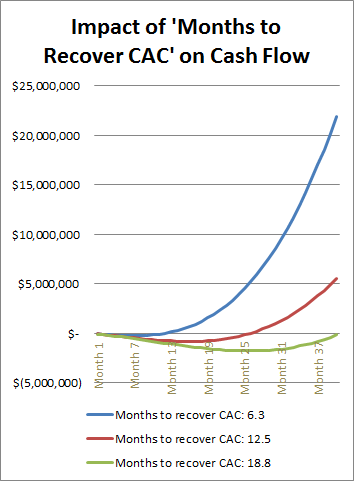

Because of the losses in the early days, which get bigger the more successful the company is at acquiring customers, it is much harder for management and investors to figure out whether a SaaS business is financially viable. To answer the question, we need two metrics: – LTV: the Lifetime Value of a typical customer

- CAC: the Cost to Acquire a typical Customer

Is your SaaS business viable?

- LTV / CAC > 3

- Months to receover CAC < 12 minths

The best SaaS businesses have a LTV to CAC ratio that is higher than 3, sometimes as high as 7 or 8.

Three uses for the SaaS Guidelines

- decide when to hit the accelerator pedal. (use more CAC)

- evaluating different lead sources.

- segmentation: useful to examine which segments show the quickest return or highest LTV to CAC

Unit Economics in Action: HubSpot Example

Two kinds of SaaS business:

There are two kinds of SaaS business:

- Those with primarily monthly contracts, with some longer term contracts. In this business, the primary focus will be on MRR (Monthly Recurring Revenue)

- Those with primarily annual contracts, with some contracts for multiple years. Here the primary focus is on ARR (Annual Recurring Revenue), and ACV (Annual Contract Value)

SaaS Bookings: Three Contributing Elements

Every year in a SaaS business, there are three elements that contribute:

- New ARR or New MRR

- Churned ARR or Churn MRR

Expansion ARR or Expansion MRR

I recommend that you track these using a chart similar to the one below:

The Importance of Customer Retention (Churn)

In the early days of a SaaS business, churn really doesn’t matter. you lose 3% of your customers every month. When you only have a hundred customers, losing 3 of them is not that terrible. You can easily go and find another 3 to replace them. However as your business grows in size, the problem becomes different.

The Power of Negative Churn

Negative Chum happens when Expansion MRR > Churn MRR

two ways to get this expansion revenue:

- Use a pricing scheme that has a variable axis

- Upsell/Cross-sell them to more powerful versions of your product

For more on this topic, you may wish to refer to these two blog posts of mine:

- https://www.forentrepreneurs.com/why-churn-is-critical-in-saas/

- https://www.forentrepreneurs.com/multi-axis-pricing-a-key-tool-for-increasing-saas-revenue/

for how to calcualte LTV:

Defining a Dashboard for a SaaS Company

Detailed definitions of the various metrics used

https://www.forentrepreneurs.com/saas-metrics-2-definitions-2/

Revenue Churn vs Customer Churn – why are they different?

Getting paid in advance

Calculating CAC and LTV

https://www.forentrepreneurs.com/ltv/

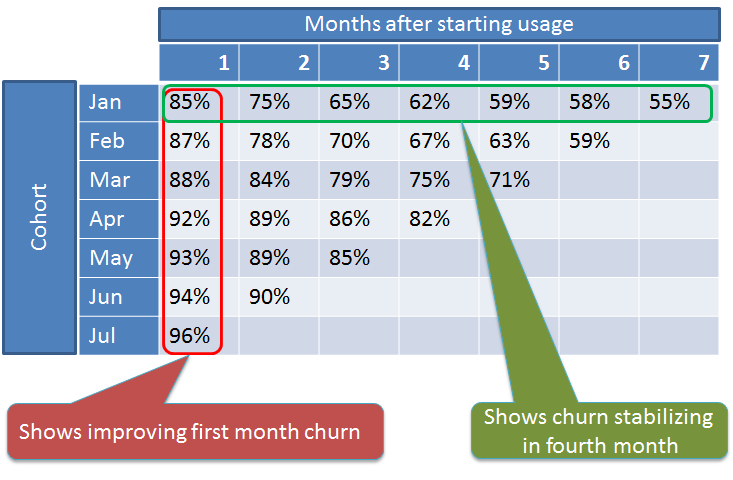

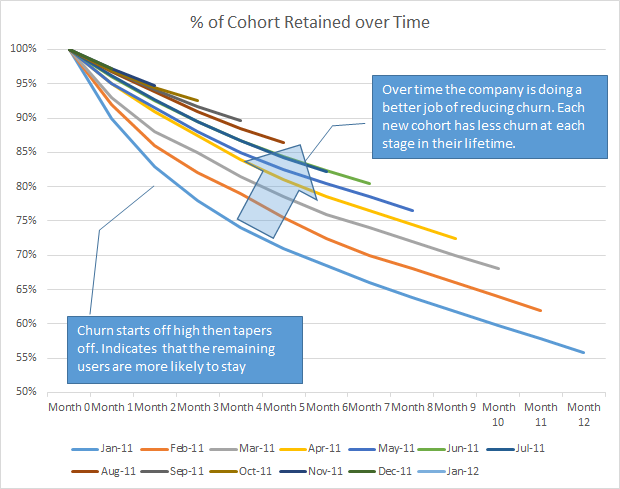

More on Churn: Cohort Analysis

This can help answer questions such as:

- Are we losing most of the customers in the first couple of months? if so, then we could do somehing see if helps, then watch the churn rate changes in next month.

- Does Churn stabilize after some period of time? most time it should, else something wrong with your product.

Two ways to run Cohort Analysis

- looks at the number of customers

- looks at the Revenue

Predicting Churn: Customer Engagement Score

create a Customer Engagement Score, based on allocating points for the particular features used. Allocate more points for the features you believe are most sticky.

NPS – Net Promoter Score

Guidelines for Churn

We recommend that you work on fixing the problems that are causing this before you go on to worry about other parts of your business. Some of the possible causes of churn are:

- not meeting your customers expectations.

- product may not provide enough value

- Instability or bugginess

- product is not sticky.

- making it a key part of their monthly workflow, and/or have them store data in your product that is highly valuable to them, where the value would be lost of they cancelled.

- You have not successfully got the customer’s users to adopt the product.

- Your sales force may have oversold the product, or sold it to a customer that is not well suited to get the benefits

- You may be selling to SMB’s where a lot of them go out of business. It isn’t enough that what you’re selling is sticky. Who you’re selling it to must also be sticky.

- You are not using a Price Scheme that helps drive expansion bookings

The Importance of Customer Segmentation

Despite the added work to produce the metrics, there is high value in understanding the different segments.

For each segment, we recommend tracking the following metrics:

- ARPA (Average Revenue per Account per month)

- Net MRR Churn rate (including MRR expansion)

- LTV

- CAC

- LTV: CAC ratio

- Months to recover CAC

- Customer Engagement Score

Funnel Metrics

Using Funnel Metrics in Forward Planning

Sales Capacity

I’ve seen many businesses miss their targets because they failed to hire enough productive salespeople early enough.

Understanding the ROI for different Lead Sources

What Levers are available to drive Growth

some of the levers that these imply as growth drivers for your business:

Churn

Get Churn and customer happiness right first (if this isn’t right, the business isn’t viable

Product

first and foremost: fix your product.

- using a free trial, focus on getting the conversion rate for that right (ideally around 15 – 20%)

- Win/Loss ratio should be good

- Trial or Sales conversion rates on qualified leads should be good

Funnel Metrics

- Increase the number of raw leads coming in to the Top of your funnel

- Identify the profitable lead sources and invest in those as much as possible.

- Increase the Conversion Rates at various stages in the funnel

Sales Metrics

- Sales productivity (focus on getting this right consistently across a broad set of sales folks before hitting the gas)

- Add Sales Capacity.

- Increase retention for your sales people.

- Look at adding Business Development Reps.

Pricing/Upsell/Cross Sell

- Multi-axis pricing

- Additional product modules

Customer Segmentation

- Double down on your most profitable segments

- Look at your less profitable segments and consider changes that would make them more profitable

International Markets

Expansion internationally is only recommended for fairly mature SaaS companies that already have honed their business practices in their primary market.

Plan ahead

The High Level Picture: How to Run a SaaS Business

really matter when running a SaaS business:

- Acquiring customers

- Retaining customers

- Monetizing your customers

The second item should be first on your list of things to get right.

Once you know your SaaS business is viable using the guidelines provided for LTV:CAC, and Time to recover CAC, hit the accelerator pedal.